Podcast: Play in new window | Download

Not the premium – but the actual costs of the insurance policy. That’s what people think they grasp. When you pull back the curtain you see that insurance costs are often excessive – but the illustration will never tell you that! I’ve got some guests here who are ripping the veneer off the facade. Listen to Barry Flagg of Veralytic and Steven Zeiger of KB Financial as they teach financial advisors how to find the secret costs of a policy by going beyond the insurance illustration.

For those of you who are new to my blog/podcast, my name is Sara. I am a CFA® charterholder and I used to be a financial advisor. I have a weekly newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.”

So please subscribe!

The problem with insurance illustrations

Insurance illustrations can be misleading and comparing them can be fundamentally inappropriate.

Take a typical insurance illustration. Let’s say there is a crediting rate of 4.95%. The illustration would show the cash value growing and growing away to its hearts content with everything rosy.

But if you were to obtain a special report from the insurance company showing what the cost would be to obtain that growth, the story wouldn’t be quite as rosy. Variable life, indexed universal life, and universal life insurance companies can produce these. But you have to ask for it. Sometimes you will have to push.

If it says “variable” in the name of the product, they are required by law to produce this cost information. If it is indexed or universal, they are not required but they should be able to produce this information.

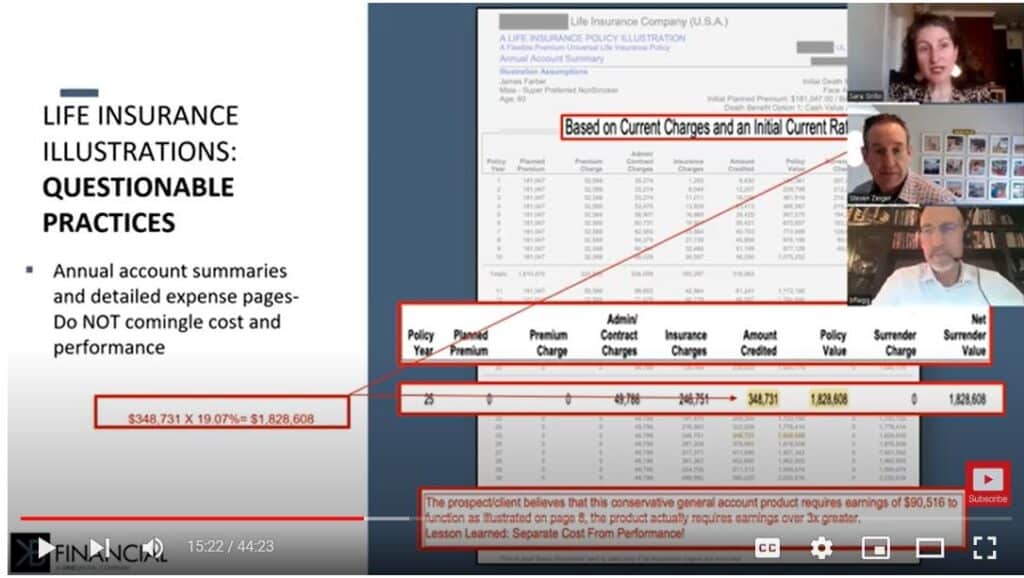

Let’s look at the policy in the 25th year.

Source: KB Financial/Veralytic

In the 25th year of this insurance illustration:

- There is no longer a premium due.

- There is a crediting rate of 4.95%.

- There is an admin charge of about $49k.

- There is an insurance charge of about $246k.

- There is an amount credited of about $348k.

- The cash value of the policy is about $1.8MM.

Quick math: If you have $1.828 million in the bank. The bank is going to credit you 4.95%. At the end of the year, you’d have earned a little less than $90-100k.

But the insurance company has to credit $348k on $1.828MM dollars that year!!!!

That equates to a 19.07% rate of return to make this insurance illustration work!!!

If not, they will not meet illustrated expectations and the policy won’t be able to afford this year’s charges. The policy won’t be able to afford itself.

Although it looks on the surface like it’s a conservative 4.95% rate of return, it’s actually an aggressive 19% rate of return. It’s impossible to figure out from the illustration – it can only be determined based upon this supplemental report that is usually not asked for by the fiduciary financial advisor or the client.

And, you have to do the math by hand.

What are hidden costs in an insurance policy?

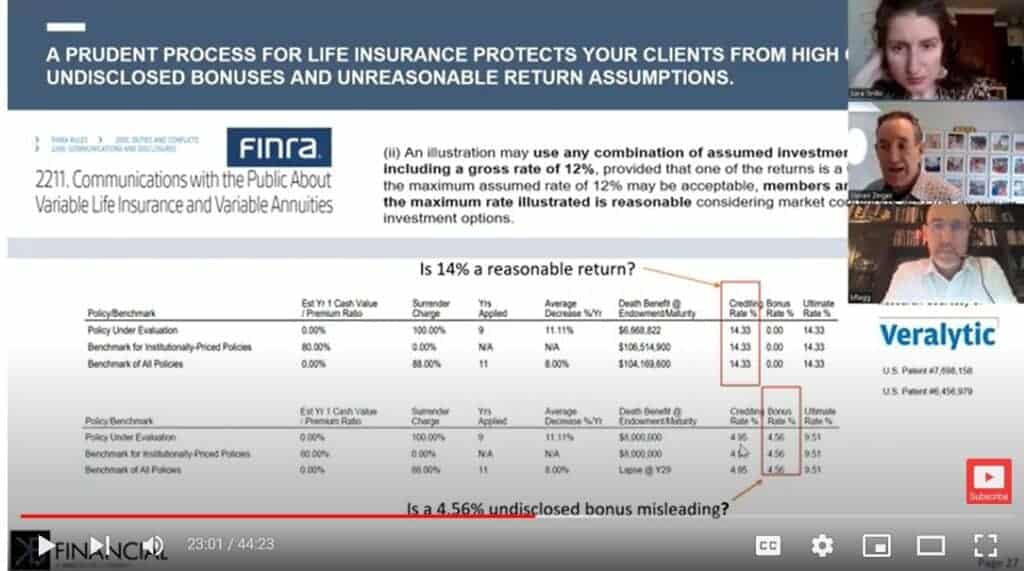

Here’s another example.

Source: KB Financial/Veralytic

Hmmmm:

- The insurance company is crediting 4.95% in the insurance illustration.

- Mathematicians were able to determine that there was an additional 4.56% bonus rate that was not in the illustration. That means the total return is 9.51%.

- That is the rate required – but the illustration was only showing 4.95%.

Slightly deceptive to the reader, no?

What does it mean for a policy to be properly structured?

A properly structured insurance policy:

- Reduces cost relative to benefits

- Contains illustrated performance expectations which are reasonable

- Has risk of underperformance that are appropriate to the client’s risk profile

A policy that is structured for cash value accumulation will have costs structured differently from a policy that is set up to allow for the maximum possible death benefit. In the former case, you would want lower premium loads, because you want as much money working as possible. If you are trying to put in as little as possible and get the maximum death benefit, loads don’t matter as much. Cost of insurance charges (COIs) don’t matter as much for this type of policy. These types of charges are usually 85% of total cost. So in a case like this, you want to make sure that these COIs are as low as possible.

How do you apply fiduciary rules to evaluating life insurance?

Insurance regulation has been well-intended but it’s not enough.

- The Life Insurance Models Regulation was an attempt to normalize the way insurance companies calculate premiums and cash values. That was promulgated in the 1980’s by the NAIC.

- In 2015, they came out with AG 49 because the crediting rates appeared similar from company to company but were actually very different.

- Then they concludes that this didn’t fix it, so they came out with AG 49-A.

- In 2023, they concluded again that their methodology didn’t work so they came out with AG 49-B.

(sigh)

Is regulation really the answer? Is controlling the inputs and outputs really going to solve the issue of deceptive insurance illustrations?

It may help, but a better answer is that fiduciaries must apply higher diligence to uncover the truth about these insurance policies whenever they are advising their clients on a new or existing policy.

Fiduciary financial advisors need to analyze:

- Are costs justified relative to values?

- Are performance expectations reasonable?

- What are the real risks of underperformance/lapse?

Fiduciaries don’t try to compare one hypothetical illustration to another using a failed regulatory regime. They analyze the aforementioned factors in a diligent factor. Fiduciary should be an operating principle, not just a marketing term. If fiduciaries were to behave as fiduciaries there would be fewer issues with these life insurance illustrations!

The New York Court of Appeals Constitutionally affirmed Reg 187 in October 2022. It requires care, skill, prudence, and due diligence (a best interests standard of care) to be followed when selling insurance. This is the first state to pass such a “best interests” regulation; it’s possible California or other states may follow suit – but then again, who knows.

So did we expose the truth about insurance illustrations, or what?

I hope you’ll subscribe to my newsletter.

Join our next Transparent Advisor virtual meetup.

These meetups are free and the goal is to learn from each other about how to grow and manage a transparent practice for the benefit of clients.

Even if you can not make the meetup, or even attend in its entirety, please register for the replay and to be notified of the next one. We meet on the second Wednesday of the month at 1 PM ET.

Learn what to say to prospects on social media messenger apps without sounding like a washing machine salesperson. This e-book contains 47 financial advisor LinkedIn messages, sequences, and scripts, and they are all two sentences or less.

You could also consider my financial advisor social media membership which teaches financial advisors how to get new clients and leads from LinkedIn.

Thanks for reading. I hope you’ll at least join my weekly newsletter about financial advisor lead generation.

See you in the next one!

-Sara G

Sources

Megregian, Donna. (2021, February). What’s in the “A” of AG 49-A. https://www.soa.org/sections/product-dev/product-dev-newsletter/2021/february/pm-2021-02-megregian/

Morelli, Steven A. (2023, May 1). Will AG 49-B be a May Day or meh day for IUL illustrations? https://insurancenewsnet.com/innarticle/will-ag-49-b-be-may-day-or-meh-day-for-iul-illustrations

National Association of Insurance Commissioners. Life Insurance Illustrations Model Regulation.

New York State Department of Financial Services. Suitability and Best Interests Regulation https://www.dfs.ny.gov/apps_and_licensing/agents_and_brokers/Suitability/Best%20Interests%20Training

Pence, Travis. (2017, Nov 15). The Impact of AG49. https://blog.advisors-resource.com/blog/the-impact-of-actuarial-guideline-49

Insurance illustration podcast transcript

0:00:00.0 SARA GRILLO: You’re not a fiduciary if you don’t know what your client’s life insurance is costing them, not the premium folks, but the actual cost of the insurance policy, that’s what advisors think that they grasp. But when you pull back the curtain, you see that insurance costs are often excessive, but the illustration will never tell you that I’ve got some guys here who are ripping the veneer of the insurance industry, they are very flag of paralytic and Steve ager of KB Financial. Hey guys, welcome to the show. Thank

0:00:34.9 BARRY FLAGG OR STEVEN ZEIGER: Great to be here.

0:00:37.3 SARA GRILLO: So let’s start in here. What is an insurance illustration is

0:00:41.3 BARRY FLAGG OR STEVEN ZEIGER: Barry wanna start off in all and in a little more color… Sure. Insurance illustrations were created in the 1980s with the advent of a new type of product called new back then you do call Universal Life, where premiums were calculated using computers in the offices of the insurance professionals, this differed from prior to 1980 when premiums were calculated by actuaries and since I’m the son of an actuary, I can make fun of actors, they were calculated by actuaries in dark rooms with the green visors and the pocket protectors, and the whole IRS, but the premiums were given to the insurance professionals prior to 19… The night proof, the advent of universal life, but then with the aversive sons could calculate the premiums in their offices, and so the National Assistance Commission said, Well, wait a minute, if we’re having two different people calculate the station, these premiums differently, to me to make sure that there’s some consistency between the way the actuaries are Captain premiums and the insurance professionals are calculate premiums, and since the insurance professionals get paid when they sell a premium, there’s an inducement or an incentive for that premium to be as low as possible.

0:02:10.4 BARRY FLAGG OR STEVEN ZEIGER: So the National Association of reference commenters came out with rags called the illustrations model regulation that says, Here’s what you need to do in order to calculate premiums, similarly so that consumers… ’cause back then, there was no way, no, absolutely no way to understand what’s actually being charged in side of policy, so this illustrations model relation was intended to provide guidance for calculating premium similarly, so that the premium would be a rough proxy of the costs in the illustrations modulation and insurance illustration is a depiction, a depiction of what could happen under certain situations that are supposed to be controlled by this insurance model regulation, but as we’ll talk about today, that has been a fool’s errand, they can’t… They’re trying to regulate the outcome, and it simply has not worked, so picture this illustration, it’s 50 pages as long… If I’m 50 years old, the illustration is going to go from age 50 as 120, so there’s 70 rows of numbers, and then there are five to 10 columns of numbers, so you can imagine it’s pretty difficult to compare one illustration versus another illustration because there are thousands of different points on a 0% or 5% on a 565%.

0:03:44.9 BARRY FLAGG OR STEVEN ZEIGER: That’s what really makes paralytic so easy, because overly benchmarks illustration against the life insurance industry benchmarks, and you can easily see where you fall along continuum by my costs are lower than everyone else’s… Great, let’s party. My costs are the same as everyone else’s. Okay, it was just average. Can I improve upon that? How my costs are much higher than everyone else’s, I need to find someone who knows how to use this research, and the second thing I wanted to say about at illustrations is it’s… I remember the first time I heard this illustration of co-mingle cost and performance and take a step back, what North does that mean? So I think the easiest way to think about that is, let’s pretend we’re all looking at an illustration, and the upper right, it says a 5% rate of return… And illustration, at a 5% rate of return. Logically, people would think the insurance company is earning 6% on their money, they’re to take 1% for their blimp and their stadium and the actuary and all their costs, and it’ll lead me with 1000 basis points last 5%. But an illustration, it’s impossible to tell whether they’re really thinking that they’re crediting 15%, charging me the difference between 15% and 5%, and leading me with 5%, it’s impossible to tell which one’s which, and that’s what really makes illustrations…

0:05:32.7 BARRY FLAGG OR STEVEN ZEIGER: Confusing, misleading. And comparing them fundamentally inappropriate.

0:05:39.2 SARA GRILLO: The crediting rate that you see in the illustration is a net of expenses crediting rates. They did

0:05:49.4 BARRY FLAGG OR STEVEN ZEIGER: It, me interject here what the meaningfulness of that crediting rate is, and this is one of the things that the NIC has been playing WACA all with in trying to regulate. So if you put money into a policy and a policy that’s cash value, a permanent policy, not a term policy, if you put money into a policy that last longer than life expectancy, the money goes into the account, the insurance company deduct costs, cost of insurance premium loads, administration expenses, sometimes accountant account value-based, like wrap fees, so they deduct their costs, whatever is left over, earns something that aren’t an interest rate, or it’s invested in mutual fund like account. And it grows or doesn’t grow. But whatever that growth is, whatever that interest is, that reduces what the client has to pay to cover those costs… The costs are the costs, those costs have to be covered for the policy to last, so the cost either is covered by the client’s money or earnings on the client’s money, and so the game that the illustration beauty contest does is the higher you can make the assumed return the lower the premium or the apparent premium that the client has to pay, but ultimately those costs have to be covered, and so if those earnings assumptions at the beginning don’t actually come true, which I see was talking about, if they don’t Absalom true.

0:07:33.7 BARRY FLAGG OR STEVEN ZEIGER: Then the client gets a premium call for more than they originally were quoted a bat and switch, if you will.

0:07:42.9 SARA GRILLO: And this is in universal life insurance policy, illustrations.

0:07:48.1 BARRY FLAGG OR STEVEN ZEIGER: All forms of insurance in last guarantee, so for instance, a whole life policy as a guaranteed premium, but the number of payments that are required are more often than not guaranteed, so while the maximum of the insurance company can charge per year is guaranteed. A whole life Hall policy might quote a 10 bag and the 10-page and turn into a 20 pay or forever pay, if this same thing happens where the interest rate required to make the illustration work required to meet expectations, if that interest rate doesn’t come true, then the client will have to… We’ll get a premium call and we’ll have to pay more to keep the coverage going, and as Steve said earlier, knowing whether or not that rate of return… What that rate of return is in some cases, and whether that rate of return is reasonable is impossible to tell from an illustration alone. Let’s just summarize. So the illustration, it’s really not a representation of what’s going to happen in the future is truly not a forecast of what’s going to happen to this feature, it’s not a prediction of what’s gonna happen in the future, it’s really an explanation of how does this thing work? It’s a lesson.

0:09:10.5 BARRY FLAGG OR STEVEN ZEIGER: And maybe say, Hey, what happens if I lower this? What happen? But again, it’s not a representation, it’s not a forecast. It’s not a prediction. It’s really, how does this work? To What If Analysis, what if I pay… So I’m doing my cash flow planning in my retirement plan, and I say, You know, I don’t wanna have to pay for in as a retirement. So what if I increase the premium? What if I decrease the Prem? It is a good… What if analysis tool? It is, and Steve used the word misleading, fundamentally an appropriate and reliable, those are not his words, vines illustration, comparisons misleading. The Society of actuaries, Dems, comparing illustrations fun, not just inappropriate. Fundamentally inappropriate, and the OCC, the regulator for the largest body of fiduciaries in the United States, National banks have a book, they issue a book for a unique and hard to value assets, which includes a chapter for life insurance, and in that chapter, they say… These illustrations are subject to a high degree of fluctuation and not reliable, therefore not reliable for comparing which policy is better or not, as Steve said, These are 50 pages long, and they include literally thousands of numbers, and so it is difficult seeing one on paper, right in front of you is difficult to get your head around, seeing it online is arguably impossible.

0:10:50.7 BARRY FLAGG OR STEVEN ZEIGER: So what that’s worth. Okay.

0:10:54.1 SARA GRILLO: What does it mean for a policy to be properly structured?

0:11:00.6 BARRY FLAGG OR STEVEN ZEIGER: So I often hear insurance professionals who are more on the sales person side of insurance professional than the fiduciary orientation of insurance profession, I often hear them say, I know how to properly structure a policy, I structure it properly, others don’t. And when I ask them, what does that mean? Like you just asked us very… You have a good answer for that. At least in my experience, properly structured from a fiduciary perspective is a structure that reduces costs so that they’re justified relative to benefits, it structures the policy where the illustrated expectations are reasonable to expect and the risks of underperformance are appropriate to the client’s risk profile, and those can be all kinds of different things, but I’ll give you a couple examples. So there are products that are specifically designed for accumulating cash value, accumulating account values, there are product products that are specifically designed for providing the maximum amount of death benefit for the minimum amount of premium, and those policies, the policies that do well in each of those circumstances, have their costs structured differently, for instance, if it’s a policy that we’re trying to put as much money in into it as possible, you want low premium loads in the same way that you don’t wanna put money into a mutual fund that has a sales load, which almost none do anymore.

0:12:51.6 BARRY FLAGG OR STEVEN ZEIGER: You want your money, you want as much money working as… So you want low premium loads and low account value-based fees, if you’re trying to grow the account on the other side, if you’re trying to put in as little as possible and you’re trying to get the maximum death benefit per premium, then premium loads don’t matter as much and cost of insurance charges, which are the biggest expense, particularly in a minimum premium defined benefit design cost of insurance charges are 85% of total cost, so you wanna make dog unsure you of insurance charges are as low as possible, those are examples of properly structured for the different clients goals, circumstances, objectives and constraints, to give sort of a funny analogy, I was speaking with a guy who’s really into cars a couple of days ago, and he has… His policies, there are accumulation policies, so they all say the word of accumulation of them, but he purchased them for death benefit purposes… Not accumulation purposes. And I said to him, I do this for a living, and I know you don’t do this for a living. Now, let me give you an analogy. Let’s pretend that you want to design and as you vet go through the woods and over Taishan through rivers and stuff, but you design a chassis of a sports card.

0:14:27.4 BARRY FLAGG OR STEVEN ZEIGER: How do you think that would work out? And he said, Oh, a little bit, it’s cassette sports cars designed to be really light, really it nimble and to give up some strength in exchange for… Exactly. So we’re talking about the structure of the policy. There are certain policies that are designed to accumulate cash, others that are designed for maximum and that benefit, just like the chase of a car is designed to get you down the highway, but you gotta take that car for wheeling, but by lunch time, you’re gonna need a new car. Can everybody see my screen with some little red pop-outs on it. Okay, so on the upper right, the illustration is based on an initial rate of 495, Bertha.

0:15:12.4 SARA GRILLO: Does initial rate

0:15:13.3 BARRY FLAGG OR STEVEN ZEIGER: Means how much is the insurance company crediting persons on the policy owner account today?

0:15:21.1 SARA GRILLO: Okay, so that’s also called the crediting rate, yet also called the earnings rate…

0:15:30.1 BARRY FLAGG OR STEVEN ZEIGER: Yeah, frequently. Not for this product type, but for a different product type… Yes, it would be called the Ernie. Right.

0:15:38.9 SARA GRILLO: Okay, so the create percent, right?

0:15:44.5 BARRY FLAGG OR STEVEN ZEIGER: Now we’re going to do is, we’re not going to look at the illustration because we already learned that the illustration can be misleading, and comparing illustrations can be fundamentally inappropriate, now we wanna do is you wanna look at what’s the premium… What’s the premium charge, but the admin charge, what’s the cost of insurance charge, and how much is the insurance company crediting? And now we’ve opened up the black box, we can look at this almost like it’s an Excel spreadsheet, this is from the insurance company, we have them produce a special report that’s not part of the illustration with a special report that they can produce for us.

0:16:25.1 SARA GRILLO: Did all of them do that?

0:16:28.0 BARRY FLAGG OR STEVEN ZEIGER: All so variable life, indexed universal life, and universal life, the insurance company can produce this for life

0:16:38.2 SARA GRILLO: Alive, the details matter so much, you see that… I’m sorry. They can produce it or they have to produce it, and if you ask for it, they have to give it to you, or it’s just… If you ask, they might give it to you, which one is it?

0:16:53.5 BARRY FLAGG OR STEVEN ZEIGER: Usually they’ll give it… Sometimes you gotta push

0:16:55.9 SARA GRILLO: As the financial advisor representing the consumer, does the consumer have a legal right to this information from the insurance company? Variable products, yes. Variable making variable life, universal life, anything that goes with the market is based on the performance of an index or the market, the market.

0:17:16.3 BARRY FLAGG OR STEVEN ZEIGER: So not… So this is variable in the name of the product, they are required by law to produce this information, it’s indexed or universal, they’re not required, but they should be able to produce this.

0:17:33.6 SARA GRILLO: They should. Yeah. Okay, should… Okay.

0:17:37.5 BARRY FLAGG OR STEVEN ZEIGER: So now what we’ve done is we’ve picked out the 2050 year, right, you can see whatever… In this example, the premium is no longer do being a charge this year, there is no premium charge, there’s an admin charge of 49000, there’s an insurance charge of 246000, is the mount credit of 348000, and the cash outhouses currently 18-28 million. Now, quick math, if you have 128 million in the bank in your Christmas or Hannukah Club, and the bank is going to credit you 5% on your money

0:18:18.4 SARA GRILLO: Or Sree, 495%, which was the credit in… Great that we described earlier. So, okay, so it’s… You’re said five, but it’s really 49 psi just imagining…

0:18:31.5 BARRY FLAGG OR STEVEN ZEIGER: I’m just on… You just ring the game and you say, you’re gonna put your money and to sign your Bank and Trust for your Christmas account for Hancock, and we promise to pay you a 5% return on your money. So if you gave us 182-8 million at 5% at the end of the year, how much do you think you would have a little less than 00? Yeah, so 10% would be a 1080 year end. So 5% is gotta be that name or a… Not a, but here, but the insurance company’s crediting 1828 million, a 107% rate of return. When at the top of the illustration to everyone, I… 495%. Let me take issue with one word, you said the insurance company is crediting, the insurance company has to credit… They’re currently crediting 495, but in the 25th year, to make their illustration work, they will have to credit 1907% in that year to meet illustrated expectations, they’re not crediting that they will have to… 25 years from that. Yes, threat. And if they don’t, it doesn’t work why policy will fall apart, because my policy won’t be able to afford this year’s admin charge of postal 50 grand and my insurance charges of another 250 at…

0:19:59.4 BARRY FLAGG OR STEVEN ZEIGER: I’m going to be charged 300000 in cost, and if I don’t have that amount to the policy can’t afford itself… So we’re not here to say whether this insurance company and credit 19-07% or that they can’t… We’re trying to point out is, unless you look at the iPad, unless you look at this report, you’ll never know that what looks like a 495% conservative rate of return is actually an aggressive 19% rate of return, and it’s impossible to figure out from the illustration it can only be determined based on this supplemental report, that’s usually not asked for by the fiduciary or the agent or the client is, and you’ve gotta do that math, and you gotta do the math that Steve just did by hand, it is nowhere in the illustration either by it, you gotta do it by hand for every single year, or you get a vertical report like Steve was… Right.

0:21:04.2 SARA GRILLO: Okay, so what you’re saying that you did there, just to refresh, just to review the map, what we did was we took the report that we took the illustration that was showing a crediting rate of 495%. We then went to the report that the insurance company gave us that showed the illustration assumptions, and those assumptions show that in the 25th year, it would be 3480731 that would have to be credited in order to overcome the admin contract charges and the insurance charges added together to overcome the expenses of this policy in year 25, the marred, it would have to be 348000, which would be a 19% rate of return, 495% rate of return, that is nearly four times the rate of return that was illustrated in the illustration that the insurance company gave, if you did not have this illustration assumptions document, you would not understand the preposterous nest of only 495% actually being credited, because you would not understand the expense shortfall that the policy would be bearing in the 25th year.

0:22:39.0 BARRY FLAGG OR STEVEN ZEIGER: Nor the aggressiveness of the performance assumptions. Right. Okay, I’m gonna switch slides for a second, but now we have… This is one of the reports from Verein. This particular… Not the example, we just showed… Another example, the insurance company was crediting 495% in the illustration, paralytic mathematicians were able to determine that there was a 456% bonus rate that wasn’t in the illustration, which means the total return is 95 per 1%. That’s what’s required, but the illustrates was only showing 49%, that’s one of the tools we use to help fiduciaries and clients make better decisions. So the illustrations, remember back to what is an illustration, the illustrations model regulation was an effort to try to normalize the way insurance companies calculate premiums and cash values, and that illustrations model relation was problem Gadi 1985 era. In 2015, the AIC of their own conclusion said, Well, wait a minute, we got insurance companies calculating premiums using apparently similar crediting rage, but vastly different credit. And so they came out with a 49 to fix it. So 1995, they try to fix it, 2015, they try to fix it, then they count with… Then they concluded up again of their own conclusion that g49 didn’t work, so they came with a 498, and this year, they’ve concluded again that their regulatory methodology didn’t work, and so they came out the A-G-49 going into a fact…

0:24:41.5 BARRY FLAGG OR STEVEN ZEIGER: I think this May… So we got illustrates the motor Gulati on in 1995 at 49-a049-B, three times a charm. Their approach, they’re trying to regulate the inputs and the outputs instead of what fiduciaries do, fiduciary, don’t try to create some mechanism for generating a hypothetical proposal that can compare to some other hypothetical problem neither which will ever come true. Fiduciaries analyze costs are cost justified, relative dementias, fiduciaries evaluate the reasonableness of performance expectations, an aggressive investor will have an aggressive client, a client in aggressive profile will have a different risk tolerance than somebody who has a conservative risk profile, and so we shouldn’t try to regulate the return, we should evaluate the reasonableness of the return and then assess the risk of under-performance relative to client recommends, so fiduciaries don’t compare hypotheticals using a failed regulatory regime, fiduciaries analyze cost, evaluate performance and assess risks…

0:25:58.0 SARA GRILLO: I’m freaking believable. You guys… Unbelievable, so there’s so much more to it than a lot of advisors realize, and I wish it was, I could say, Well, it’s just the new advisors, but it’s not because there are… That have been in this for years, that have no idea what you just showed us.

0:26:22.8 BARRY FLAGG OR STEVEN ZEIGER: Well, and let me say so in 1985. Alright, sorry. In 1995, when they came out with the illustrations, Bodega ion, I’m not suggesting for a moment it was not well-intended, there was no means of analyzing cost, evaluating, perform, there was no Morning Star for life in turn, so the illustration moderation was well intended. I think there are efforts to improve it are well intended, they’re recognizing the abuses and they’re trying to fix it, but they come from a world that doesn’t have a fiduciary orientation, so they don’t have the fiduciary framework or a thought process of cost, performance, arrest, cost performance and risk, and so they’re trying to fix a flawed regulatory game, all with good intentions. I do not, this is not some conspiracy to defraud consumers, I think in some cases, it ends up being that not a conspiracy, but it ends up being a misrepresentation that induces a consumer to buy something they wouldn’t otherwise have bought, but it’s not… Ill intent. It’s all well intended. It just needs to have more fiduciary orientation to it.

0:27:39.3 SARA GRILLO: Well, yeah, the fiduciaries have to bring fiduciary, it’s your responsibility to be a fiduciary in this kind of a situation, and fiduciary is not just something that you write on your website, it’s carrying out analyses such as these to gain the information that the non-fiduciaries are going to present to you…

0:28:02.3 BARRY FLAGG OR STEVEN ZEIGER: Sorry, you’re making me laugh because Steve can tell you there is a growing number of insurance distribution organizations that are putting fiduciary into their name, ’cause it’s a good marketing term right now, ’cause the awareness of the importance of fiduciary practice is on the rise with the consumer so there are a growing number of insurance organization putting the word fiduciary into their name, but as you said, it’s not a marketing principle, it’s an operating principle, and so just because somebody puts fiduciary their name, don’t automatically assume that they operate based on fiduciary principles. If you’re a fiduciary, ask them about their operating principles, ask them, do they provide cost disclosures to their clients, not upon request, as a matter of course, do they provide cost-determined cost disclosures, do they provide an evaluation of the reasonableness of performance requirements, do they do a risk assessment for under-performance, that’s what finials do, that’s what organizations who support fiduciaries, do you… I couldn’t agree more that it is not the word fiduciary, it is, do you behave or do you operate like a fiduciary or to support for this year?

0:29:33.9 SARA GRILLO: I think you know the advisors, everyone wants to say, Well, I’m the only advisor and I’m a fiduciary, and then there are those fiduciary principles, the five fiduciary principles that everybody likes to recite, but I wish that there was more acknowledgement of actions like these, that fiduciaries need to take… Because I think there’s this whole marketing chance, but then what are the operational duties of a fiduciary? This is one of them, there are many others that’s not emphasized, what’s emphasized is the virtue signaling aspect of being a fiduciary, New York Court of Appeals, constitutionally affirm regulated regulation 187. So what exactly does this mean? And

0:30:26.4 BARRY FLAGG OR STEVEN ZEIGER: I think is a great tie-in, because the New York regulation actually uses the fiduciary language that the two of you to spoke about, the regulation requires use of care skill prunes and due diligence. And so if we run down to an RIA together, what’s that are gonna do and they’re managing a money, they’re gonna benchmark our performance, again, they’re gonna say, How did your money do compared to the S and P-5 order, the Dow Jones Industrial Average, the benchmark. And one of the things we spoke about during our webinar a couple of weeks ago, how do you benchmark life insurance? We’re doing the same thing, we’re looking at cost, performance and risk, just like… So we’re doing that same, I think of all of the fiduciary duties, when you start to explore what is each one, due diligence, to me is the one that just bang, just running an illustration, and I sticking it in an Excel program after someone else runs another illustrate that’s not due diligence. When the regulators are saying, it can’t do that, that’s forbidden. If that makes sense. So the New York State Court of Appeals constitutionally affirmed regulation 1807 on.

0:31:50.6 BARRY FLAGG OR STEVEN ZEIGER: It was October 20th, 2022, and now California is trying to implement a similar version of this New York best interest regulation, New York and California are bell weather states. Usually when they implement something, other states follow through, and hopefully this is all better for the consumer.

0:32:16.2 SARA GRILLO: So who is the best interest in upon the insurance agent selling the policy or the fiduciary financial advisor that’s helping the client by the policy.

0:32:29.2 BARRY FLAGG OR STEVEN ZEIGER: So the regulation is clearly written towards the insurance agent with the insurance broker, but every fiduciary ethically should demand that the financial services person involved in the insurance, that they follow the tenants of this regulation. So ethically, I think it applies everywhere. If I’m a fiduciary in Arizona and I have a client who needs 5 million of life insurance, and I haven’t read the Arizona regulations. I don’t know if they’re already, but let’s just assume for a moment that there aren’t… The insurance advisor has no obligation to work in the client’s best interest, so either A that the fiduciary in Arizona should say to the insurance advisor in Arizona, and here’s a copy of the New York regulation. Can you follow it? And the person would say, Sure, I’d lock. Why wouldn’t I wanna work? And the client’s best it just for the Arizona fiduciary should introduce the client to an insurance advisor in New York who works under this client’s best interest regulation, almost like the Hippocratic Oath. First, do no harm. Would you go to a doctor? You said, Just, by the way, I don’t work on that model. Where is the door? I’m not letting you touch my brain if you don’t work in my best interest, same thing here.

0:34:04.2 BARRY FLAGG OR STEVEN ZEIGER: Is that helpful? If I can add, so they’re… In every profession, there are people who put their own self-interest about the client’s interest, I think you’ll find plenty of people in the insurance profession that believe within the confines of the environment in which they were raised, that they’re doing what’s in the client’s best interest, but the meaning of that has just been a debate, the New York highest court affirmed the RG 187 because there was a fight over… Right, 18-7. The fight was that a number of associations, a couple of associations for insurance distributors say, No, no, no, no, we’re already doing what’s in the client’s best interest, we’re highly regulated, we’re doing what’s in the class best interest, your rules are unconstitutionally vague. And the high court decided now, they may be different than what you’re used to, and that may be why they seem vague to you, but they are built on 200 years literally of case law regulation, litigation on what is broadly and generally… And proved to be in the client’s best interest, which certainly includes what we talked about, cost, performance and rests. I think the meaningfulness of the New York best interest rule is that for years…

0:35:48.3 BARRY FLAGG OR STEVEN ZEIGER: I know, personally, I’ve struggled with fiduciaries. I say, Look, I came from the fiduciary world. I described the same principles you do, here’s how you do apply it to life insurance, but then somebody else would come in and say, No, no, no, no, that’s not the right way to do it. My way is better, right? And some of the New York rule proofs or affirms is that… No, no, no, no. The fiduciary way, here’s how you apply fiduciary principles to life insurance, and by the way, the New York rule is not a pure fiduciary role by any stretch of the imagination, but a Steve said it includes some of the major tenants or serving clients best interest, and you can hold it up and say, it’s not you. Steve says this and somebody else says that, no, this is the New York Department of Department of Financial Services, which as Steve is a bellwether regulator, and it has gone through the trial court, the Appellate Court and the high court in New York… To affirm that, yes, this is how you apply, at least how you start to apply client’s best interest rules to insurance products.

0:36:58.1 SARA GRILLO: This is the only state that this is doing this, New York…

0:37:02.6 BARRY FLAGG OR STEVEN ZEIGER: As is often the case for New York, California is working on it. There is a bill in the California Senate working its way through committees right now, it is expected to pass, or the rumor is any way that it is expected to pass later this summer in some form or fashion, but it’s being language… As being re-written as we speak.

0:37:26.7 SARA GRILLO: Okay, so we’re gonna wrap this up here. What are the three points you would want people to take from this podcast.

0:37:34.6 BARRY FLAGG OR STEVEN ZEIGER: Number one, get the detailed expense page, is that Steve threw up on the page, they’re too often not included automatically in illustrations, the NIC illustrations model regulation does not require that they be included, so if you’re a fiduciary, you cannot possibly analyze cost performance requirements and risk without those, and every insurance company calls them something different, so detailed expense page is kind of a generic descriptive term, policy accounting pages, but it’s the year-by-year disclosure of all policy costs and all performance requirements, number one, you have to get that page to make a prudent with a capital P decision about any product recommendation to your client, so you can wanna take number two… I guess I’d be more creative, but yet that detailed expense page really starts to… On wrap. So you can learn everything. Right.

0:38:40.3 SARA GRILLO: What if they say, I can’t give it to you.

0:38:46.6 BARRY FLAGG OR STEVEN ZEIGER: So what I’ve done is I’ve gone into the illustration software on my end and a screenshot where the button is depressed it to get the report, and I’ll send it to the first, and eventually they’ll… Oh, okay. And then they might have some other… Well, it has to go to the existing agent, but eventually you get your hands on it, but I can take… You can be delayed for a month, right, so you don’t have to be persistent, you would really get them… Sorry, the map, they have to do the man, whether it’s printed out on a piece of paper or not, the math is the illustration, so it’s the number-crunching behind the values that are regularly produced, so they have to have them… They have to have the values, some old mainframe computers for some insurance companies that are no longer in the insurance business, they would have to re-program their system to generate those pages, you won’t get those from those insurance companies and you gotta hire somebody to do that by hand, an actuary or a consultant, that is rare. You can get those pages for most every… As Steve said, some of the insurance company employees don’t you know which button to collect to generate the page, so you might have to ask more than once, but they are generally available

0:40:08.2 SARA GRILLO: And in general, operates as a fiduciary when evaluating life insurance policies for your clients.

0:40:19.4 BARRY FLAGG OR STEVEN ZEIGER: Using the uniform pedestrian as one, fiduciary examples or section seven of the uniform reinvest, as you have to justify costs, if you don’t get those pages… It’s impossible to do your job. Steve mentioned the duty to exercise reasonable care skill and caution, if you’re comparing hypothetical values, you’re gonna have to explain how comparing hypothetical values that finishes is misleading, the Society of actuaries is fundamentally appropriate, and the OCC says is unreliable, you’d have to explain how that is exercising reasonable care skill in caution is just so to be a fiduciary, you can’t do it, you can’t identify whether or not a product recommendation is in client’s best interest without those pages. It is just not possible.

0:41:07.3 SARA GRILLO: Okay, real quick, can you guys just talk about what you do, and I normally don’t say this on a podcast, but I’m just gonna ask you to do this, and the reason is, I know that a lot of people listening to this are not gonna have the diligence or the energy to go out and do these calculations and go get the cost pages themselves, so… Forgive me, everybody, and I’m not connected financially to either of these guys is there’s no financial arrangement in between us. Okay.

0:41:36.8 BARRY FLAGG OR STEVEN ZEIGER: So mine is really short, the 50 pages and the thousands of numbers heretic converts to basically two numbers in one page, and so if you are self-initiated like Steve is, then go to www dot com, by the way, our website sucks right now, we gotta update it, but you can go to paralytic dot com and you can get the research for life insurance products, cost performance and risk assessment research for life insurance products that you routinely get from Morning Star if you’re in the investment base, if you are not a self-initiated, then call somebody like Steve. Go ahead, Steve. Right now, it’s simply I help people understand how to benchmark life insurance, I help walk them through their variety reports so they can make better decisions, but that they’re purchasing a new policy or whether they are reviewing their enforce holders, it’s really a matter of… Everything lead with education. So we walk people through, how do you understand what the output… What this can… Pricing performance research steps.

0:42:54.9 SARA GRILLO: So you have the end client or you help the advisor.

0:43:02.3 BARRY FLAGG OR STEVEN ZEIGER: It usually comes through the… There’s usually a fiduciary involved, so I’m usually helping an attorney and account, an RA or a trustee, and sometimes indirectly helping the consumer or the policy owner, but at this stage, at this stage, we market to fiduciaries, they just understand this being a fiduciaries in their blood, so they understand this, they want a better outcome for their clients, and once they see a case study using this research, they see that this research can help their clients, you protect their clients or help our clients have a better outcome, so that’s where that’s… In the market that we operate 0:43:46.4 SARA GRILLO: It, thanks everybody for listening. Please subscribe to the show so that you’re automatically notified of new episodes, we’ve got a bunch of great guests coming down the pike, and we’ll hope to catch you in the next one. Thanks, everybody. Just a reminder that nothing in this podcast can be interpreted as a product, insurance or investment recommendation of any sort, nothing in this podcast can be interpreted as the legal or compliance advice, or any recommendations specific to your or your client’s personal situations. Please consult a consultant. Advisor or attorney?

Disclosures

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use, or the success of any program. Nothing in these materials may be construed as an investment, insurance, or financial recommendation.

Grillo Investment Management, LLC will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor.

Podcast transcription and summary may differ from original recording and Grillo Investment Management, LLC may not be held liable for such differences.