In this blog, Scott Salaske of Firstmetric and I discuss the proper way to read a Form ADV so that you can get the information you need to make an informed choice and avoid working with a financial advisor who is a lying, deceptive grifter. This is super important for anyone looking to pick a good financial advisor.

Don’t go about this decision without doing your research, people!

Let’s get on to the blog.

#1 Why is it important to do Form ADV research before hiring a financial advisor, or even talking to one?

Financial advisors do not always do the best job explaining things. Sometimes it is intentional. Other times they are just not great at explaining what they do and how they charge you for it. If you are not careful you can wind up paying a lot of money for crap, or even getting blatantly deceived about what you are paying for when you hire a financial advisor.

But first – what is a Form ADV?

A Form ADV, according to definition by the SEC, is a legal document that anyone who is holding him or herself out as a professional financial advisor in the United States must file with the SEC, whether they are state or Federally registered.

These filings are part of public record, and they are a gift of transparency from the regulators to the consumer. Transparency allows the consumer to decide if the services and fees offered by the financial advisor are fair and logical, and if it is in their best interest to work with that advisor. It’s also important to understand the conflicts-of-interest that a financial advisor’s business model may present, because these may bias the benefit of the service in the advisor’s favor rather than yours.

IMPORTANT: Never trust what an advisor says verbally. Always verify in writing.

What are the different parts of Form ADV?

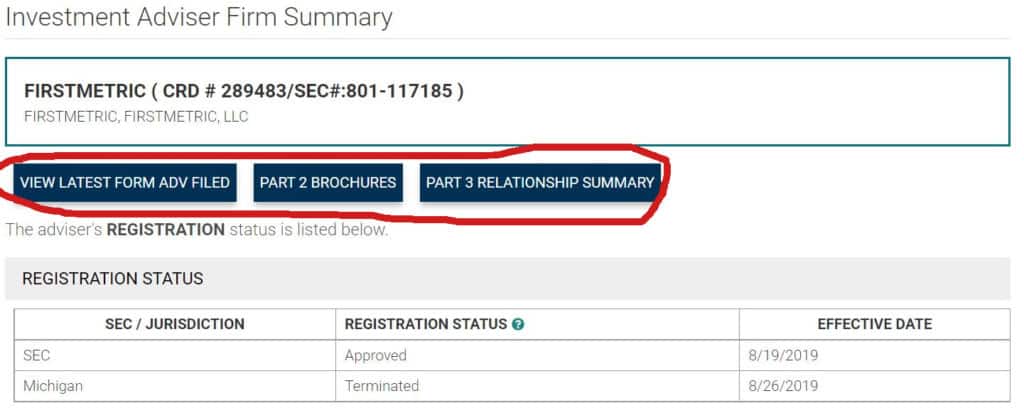

Before we get into an example, Form ADV has three parts on the SEC website you need to check out. Here is a summary of each.

Form ADV Part I

Form ADV Part I is an application. Any financial advisor who is registered as an advisor with a regulator has to fill out this form for initial approval by either a state or a Federal (the United States Securities and Exchange Commission) regulator.

The advisor fills out this application and then the states or the Federal regulator reviews it and approves or declines. The Form ADV Part I provides basic business detail about things such as ownership, clients, employees, etc.

Form ADV Part I is not designed to be a user-friendly narrative. It’s of marginal benefit to the consumer, and is really just an application for the regulators to approve or decline.

Form ADV Part 2

Part 2 is a narrative brochure that discusses the adviser’s business practices, fees, conflicts of interest, and disciplinary information. We encourage consumers to review the Form ADV Part 2 as it provides an organized view of the major aspects of the advisor’s business, and is written in a more user-friendly format.

Part 3 Relationship Summary, (also called Form CRS)

Form ADV Part 3 (also called Customer Relationship Summary) requires SEC-registered investment advisers to prepare a “plain English” summary of the data presented in Part I and II. It’s usually 2-4 pages long.

#2 How to read a Form ADV: case study

But assuming that your financial advisor is a fiduciary, one who is legally obligated to put your interests before theirs, they will need to register with a Form ADV.

Where to find a financial advisor’s Form ADV:

- You can access the IAPD, or Investment Adviser Public Disclosure directory, by visiting www.sec.gov and scrolling down.

- Or you can just go to the IAPD website directly.

This is free and you don’t even need to log in.

Type in the financial advisor’s name at the top. You’ll notice that usually more than one advisor comes up. This is because usually the search retrieves the advisor with that exact name and people with similar names. You should check the advisor’s CRD number and see if it matches what they sent you. If you ask the advisor for his or her CRD number and they refuse to provide it to you, they are hiding something – run away fast! They are probably a grifter.

What if you can’t find the financial advisor’s Form ADV?

Only certain types of financial professionals file a Form ADV. If the person is an insurance agent or solely a broker selling commission-based products, they will not have to file a Form ADV. Such folks will need to register with other entities, such as their state’s insurance commissioner or FINRA, respectively. If someone says they are an advisor and you can not find their Form ADV, they are probably not a financial advisor acting in a fiduciary capacity.

#3 What info do you need to gather?

Scott Salaske’s firm is called Firstmetric; we’ll look at the Firstmetric Form ADV as an example. Here is what to look for when you read someone’s Form ADV.

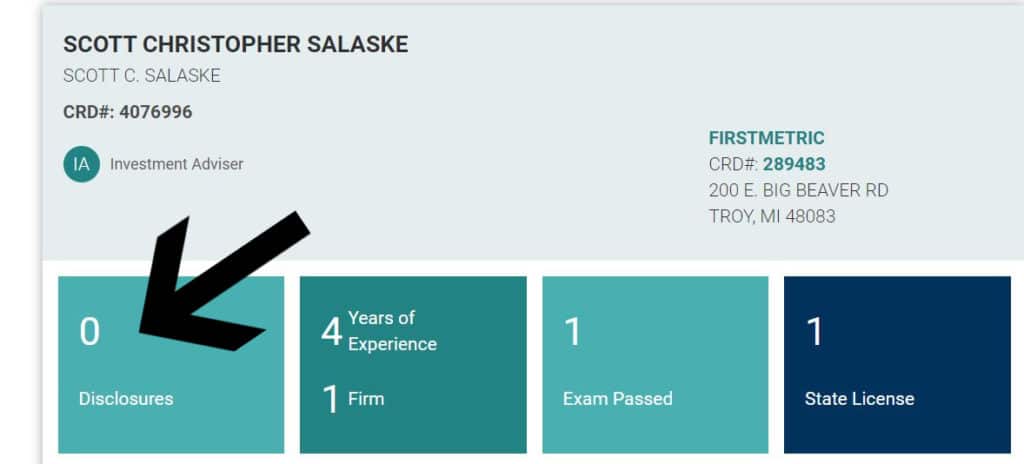

#1 Disclosures

When you visit the IAPD site, enter the financial advisor’s name. Scroll down and look for any disclosures. If they have no disclosures, you’ll see a green box with the number zero on the far left. If they have disclosures, the box will be red and you should click and read what they are before moving on.

Disclosures can be about if they have committed a crime, whether financial or not. There are also regulatory disclosures. Many times you will even see client dispute disclosures, where they may have sold a client a product that wasn’t presented properly, for example.

As can see below, Scott Salaske has no disclosures at the time of this blog being written – the box is green. If someone has disclosures, this box is red.

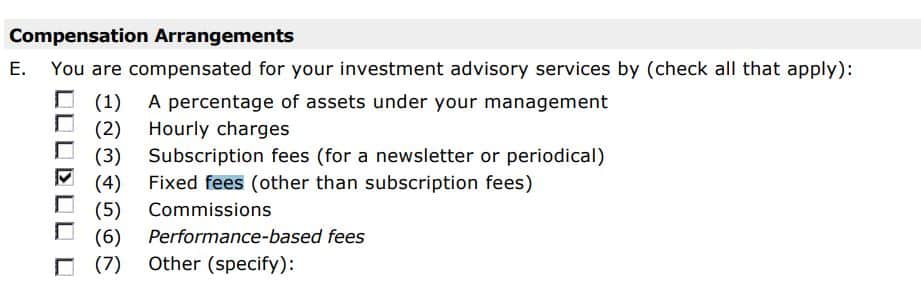

#2 Item 5 E on Form ADV Part I, Compensation Arrangements

After you check for disclosures, click on their current registrations, scroll down and click the firm name that is hyperlinked. This will take you to the page called, “Investment Adviser Firm Summary.”

Click the button that says, “View Latest Form ADV filed.”

Form ADV Part I is of limited use to a consumer, but one of the thing you should look at is Section 5 Section E, Compensation Arrangements. Look at this right away because you need to know how the advisor charges as this has a huge impact on the service you receive.

This should be consistent with what the advisor has said. If they tell you they charge a percentage of assets under management, and you see that they also charge commissions, that should indicate that they either weren’t be that honest intentionally or weren’t careful about how they explained their fees to you, both of which are of concern.

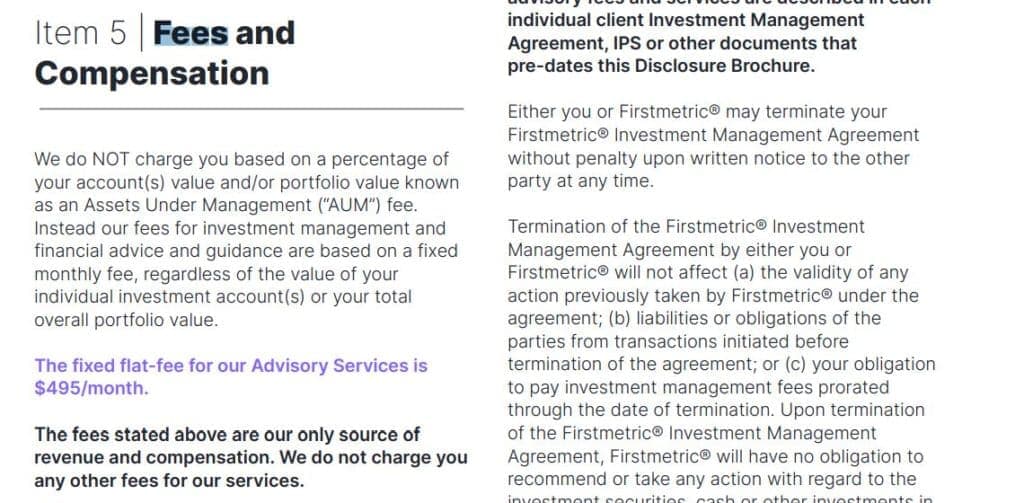

#3 Item 5 on Form ADV Part 2, Fees and Compensation

As soon as you are done examining Form ADV Part I, go back to the top of the Firm Summary page and click the button that says, “Part 2 Brochures.” This is written in brochure format which is a bit more user-friendly, but the data can be very dense and many ADV brochures are quite lengthy.

The first thing you should look at on the brochure is Item 5, “Fees and Compensation.” It’s very important to understand the fees the advisor charges because if you don’t understand the fees you are probably not going to understand the services.

#4 Item 4 on Form ADV Part 2, Advisory Business

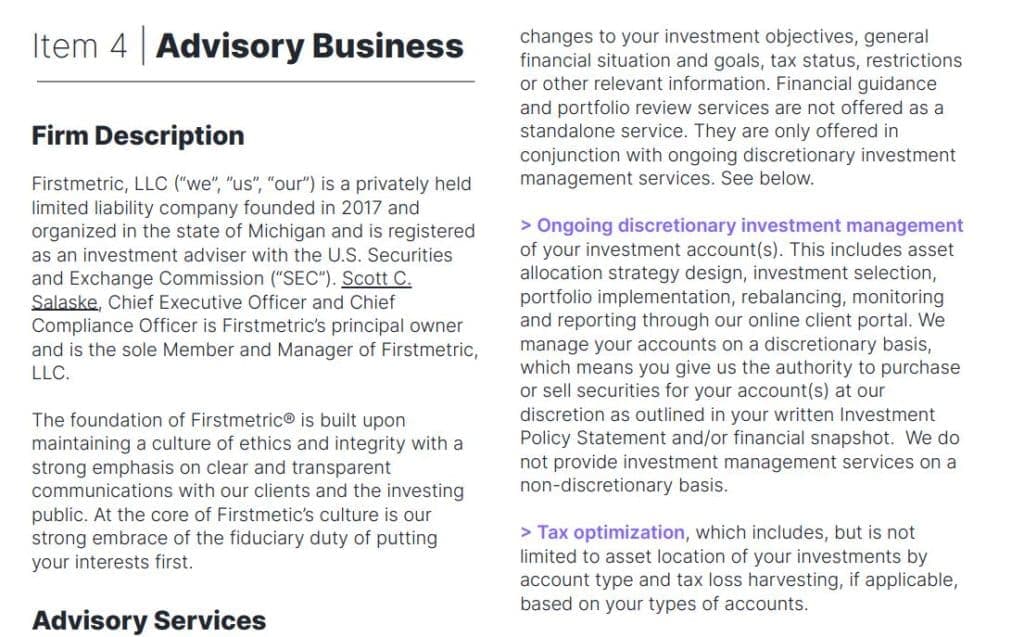

After you take some time to understand the advisor’s fees, visit Section 4, “Advisory Business.” This will provide you with a description of what the services are that the advisor provides.

- Are they just providing financial planning? If so, what does that entail?

- Do they manage money? What methods do they use?

- Etc.

Don’t assume all financial advisor business models are the same. Also don’t assume that what the advisor says they’ll do for you is what they routinely provide to their clients. They may just be telling you what you want to hear so they can get your business.

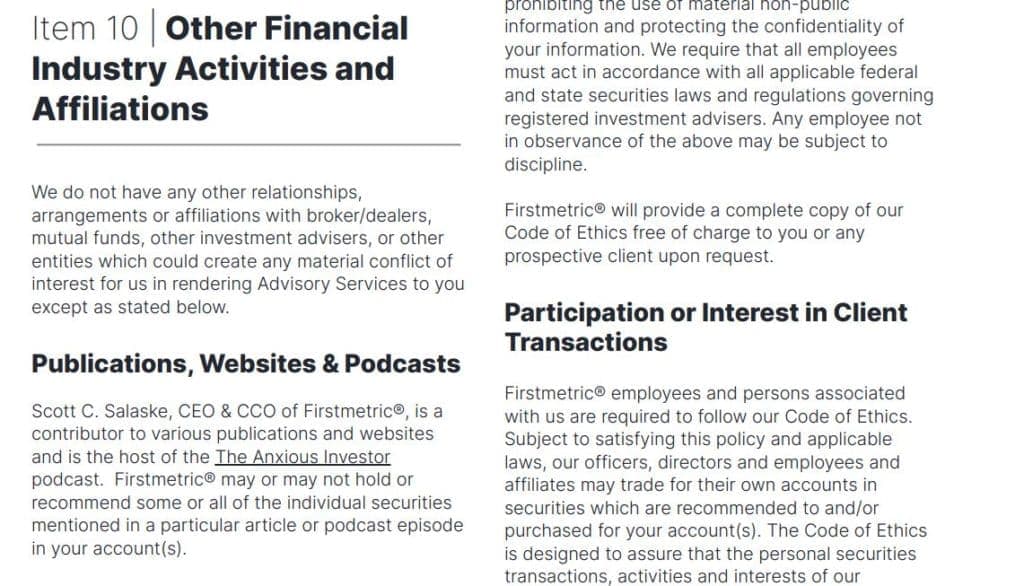

#5 Item 10 on Form ADV Part 2, Other Financial Industry Activities and Affiliations

An advisor is supposed to disclose any material conflicts of interest they may have in providing the services described in Item 4. Some of these conflicts are very much biased in favor of the advisor. They run the gamut from “we sell insurance” to “we manage hedge funds and put our clients’ money into some of those and we earn compensation for that.”

When an advisor is offering many different products or services to clients and/or has a complex business model, it’s likely there are biases that may lead them to make recommendations to other products or services that they are getting compensated for. It’s important to know what the basis for their recommendations may be and in this section you find that out.

Financial advisors don’t always mention this when they meet with you on Zoom or in person in the meeting – read the Form ADV part 2 brochure, Item 10, and find out for yourself.

#4 Things to look out for

While not a red flag per se in all instances, when you see any of the following you should take pause and try to gain higher clarity.

#1 High complexity on Form ADV Part 2, Item 4, Firm Information

If you were to see a lot of different entities, LLCs and whatnot, and it’s not clear who the advisors are, who the owners are, what entity owns what entity, that usually signals it is a bigger firm and there is some complexity to the business model. This can sometimes block transparency.

You always want to know who you are doing business with. That is the first thing that should be clear to you from reading the Form ADV.

For example, Scott’s Firm Information passage reads, “Scott C. Salaske, Chief Executive Officer and Chief Compliance Officer is Firstmetric’s principal owner and is the sole Member and Manager of Firstmetric, LLC.” But we’ve seen instances with other advisors that are much more confusing. When you get into something complex and there are 25 different entities, it makes it very hard to determine who is advising who, who owns what, and where the conflicts are.

It’s not uncommon to see a lot of complexity when you are looking at a larger RIA firm or one where there are a lot of advisors whose businesses have been rolled up and they are still operating independently under the parent umbrella. There’s nothing wrong with that inherently, but it does introduce a bit of complexity that you’ll need to take some time to sift through.

#3 Form ADV Part 2, Section 4, Item E, Client Assets under Management

You should look at this because it’s important to know if you are a big fish in a small pond. If the advisor is starting their business or just plain handles relationships that are a lot smaller than yours, you would want to know that.

The advisor may not tell you this upfront; a lot of financial advisors try to make their businesses seem a lot bigger than what they are. They think it conveys credibility. Like we said in the beginning, always verify in writing what the advisor says verbally.

#4 Multiple page description of fees on Form ADV Part 2, Section 5, Fees and Compensation

When they have to go on and on for pages about fees, there is a lot of complexity and hence a lot more potential for conflict of interest.

#5 Form ADV Part 2, Item 14, Client Referrals and Other Compensation

It’s important to know whom the advisor is paying for their referrals. You may have found out about the advisor from a CPA, for example. The CPA may have been biased to send you over to that advisor because they were getting paid for the referral without considering if that advisor really is the best person for you.

A lot of advisors hold assets at the typical custodians such as Fidelity, Charles Schwab, etc. They may be part of programs offered by the custodians which are “revenue-sharing” arrangements. If the custodian is referring you to an advisor outside the firm, look at this section and understand how much the advisor is paying to get you referred to them.

Always know what the incentives are.

#6 Crazy disclosures

When you type in an individual’s name, you can see their disclosure history. Always check this out. You can see the date of the disclosure as well as what the disclosure was. It’s possible to get one or two from bad luck, but multiple disclosures and/or crazy disclosures should be noted and questioned.

#7 Form ADV not matching up with what financial advisor says

If the research you do yields information that is majorly inconsistent with what the advisor said when you interviewed him or her, take note. They could be deliberately misleading you.

When questioned about their business, if they act squirrely or refuse to provide information, say, “adios.”

#8 Terminations that are real terminations

When you look at some of these ADVs, don’t be alarmed when it comes at the very top listing a state registration that was “terminated.” That doesn’t mean the advisor was terminated by that state per se, it just may mean they moved to a different level of regulation. If you manage more than $100MM in assets, you have to move to a Federal regulation.

If you see terminations that were not followed by other registrations, namely Federal, then that may be a red flag that the advisor got kicked out of the business for doing something bad.

How to tell the difference between financial advisors

A friend of ours, WE family offices, wrote a paper on how to tell one financial advisor from the next. We hope you’ll read it and learn how to cut through the clutter!

Sara’s upshot

In summary, there are a lot of good financial advisors out there – in fact, probably hundreds. But there are also a lot of not so good ones and of course there are criminals as well.

We hope our blog on how to read Form ADV is helpful to you. As an aside, please do not interpret this as legal advice of any sort, and it’s also not an endorsement of any particular person mentioned herein. If you are checking out a financial advisor, do your own research and consult with an attorney if need be.

I periodically blog about financial products and services so that consumers can avoid being taken advantage of by the financial services industry.

Please subscribe to my newsletter (free newsletter) to receive updates that raise awareness of consumer financial issues, so you can avoid being taken advantage of by shenanigans.

Ethics matter.

I periodically blog about financial products and services so that consumers can avoid being taken advantage of by the financial services industry. Please subscribe to my newsletter to receive updates that raise awareness of consumer financial issues, so you can avoid being taken advantage of by the financial services industry.

I wrote these blogs, you may want to read them to be a more informed consumer.

Here are some examples of things Ethical Financial Advisors do

Top Advisor Lists are Bullcrap

If you’re a financial advisor reading this and you want to leave more about how to present yourself in a fair, logical, and transparent way, join the Transparency Advisor Movement.

The Transparent Advisor Movement’s mission is to promote ideals of clarity, modesty, integrity, dignity, and client advocacy in all aspects of financial advice, with a special focus on Advice Only, Flat Fee, and Hourly service models. There is a special emphasis on clear disclosure of services and their related fees.

The Transparency Movement is the future of the industry – we welcome anyone who believes in our values to join us.

Join our next Transparent Advisor virtual meetup.

These meetups are free and the goal is to learn from each other about how to grow and manage a transparent practice for the benefit of clients.

Even if you can not make the meetup, or even attend in its entirety, please register for the replay and to be notified of the next one.

Sources

Investment Adviser Public Disclosure. Investment Adviser Firm Summary. Firstmetric. https://adviserinfo.sec.gov/firm/summary/289483

Investment Adviser Public Disclosure. Scott Salaske. https://adviserinfo.sec.gov/individual/summary/4076996

U.S Securities and Exchange Commission. Investor.gov. Form ADV. https://www.investor.gov/introduction-investing/investing-basics/glossary/form-adv#

U.S Securities and Exchange Commission. Investor.gov. Form CRS.

https://www.investor.gov/introduction-investing/investing-basics/glossary/form-crs#

Disclosures

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use or mention in any of its content, or the success of any program it may mention in any of its content. Grillo Investment Management, LLC will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor. I want to be clear that nothing in this podcast or blog can be interpreted as an investment recommendation of any type, or an endorsement of any particular person or their services. The opinions expressed herein do not necessarily represent the views of Sara Grillo or Grillo Investment Management, LLC. Also, nothing in this podcast or blog can be interpreted as legal or compliance advice. For advise on such matters, contact a legal or compliance advisor. Any similarities to persons deceased or alive are entirely coincidental.

About Scott Salaske

Scott Salaske is the founder and CEO of Firstmetric, a flat fee financial advisor firm in Troy, Michigan. Ever since the beginning of his 20+ year long career, Scott has pursued his mission of delivering high quality financial advice in a low cost and unbiased way.

Early on in his entrepreneurial journey, Scott saw firsthand the inherent flaws and conflicts of interest in the traditional sales and product driven approach, as several family members had lost a significant portion of their hard-earned life savings to high-cost, commission-based investment products and inappropriate advice.

It was at that point Scott thought there had to be a better way for investors to obtain unbiased advice and low-cost access to the financial markets. That lead him to start Quest Asset Management, with the novel idea of putting investor interests first as a fiduciary, which was practically unheard of at the time. The idea centered on the concepts of simplicity, keeping total investment costs and taxes extremely low and developing a custom investment plan for each client using low-cost asset class and index funds.

A few years later Scott merged Quest with another local investment advisory firm, Portfolio Solutions, that shared the same investment principles at that time. Several years after the combined merger, Scott went on to grow the combined firm from advising approximately $60 million in client investment assets under management to more than $1.4 billion. In early 2015, Scott sold his ownership interest in the firm. He started Firstmetric a few years later.

At Firstmetric, Scott continues his mission of delivering low cost, unbiased advice to clients. Along his journey he has been quoted in the following publications: The Wall Street Journal, Investor’s Business Daily, Kiplinger’s Retirement Report, TheStreet.com, Cheddar.TV, Crain’s Detroit Business and MarketWatch.com; among others.