Podcast: Play in new window | Download

A $100 increase in the CFP annual certification fee spurred an industry outcry, leading many to question whether the designation is worth it or not. There are more than 92,000 CFP® certificants, as per the CFP Board’s 2022 measure. Are they getting a raw deal? Is it time to say “FU” to your CFP designation?

In this podcast, I rounded up a group of veeerrrry opinionated people and we’ll be debating the subject of what is means to be a CFP® pro. Get ready for a ride as we examine it from all angles: regulatory, ethically, intellectually, etc.

It’s about to get very, very heated so let’s get on to the show!

The debaters include:

- Robert Wright, CFP®, a financial consultant with Advocacy Wealth Management. Robert will be on the “for” team.

- John Robinson (“JR”), Founder of Financial Planning Hawaii, Inc. JR will be on the “against” team.

- Scott Salaske of Firstmetric. Scott will be on the “against” team.

Just for the record, members of the CFP Board and its affiliated were asked to join for us for the podcast – all rejected or ignored the offer.

For those of you who are new to my blog, my name is Sara. I am a CFA® charterholder and financial advisor marketing consultant. I have a newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.” So please subscribe!

The CFP designation debate – key points

This was a very special podcast episode for me. Not only were the guests lively and insightful, but the topic is one central to who we are as an industry – and not that I said, “industry”, not “profession.” It brings to light the fundamental question of the role that institutions play in client outcomes, whether those institutions are truly putting the interests of the retail investor over those of their members, and the delicate balance between governance standards and the oppression of individual autonomy.

I really had a good time creating this podcast and I think you’ll enjoy listening.

In our debate we will discuss the following questions:

- The CFP Board harms consumer through its multi-million dollar ad campaigns by suggesting that CFPs are more ethical than non-CFP financial planners and by suggesting that its member standards are higher than those of regulatory agencies.

- The CFP Board promotes a faux fiduciary standard that does not require its members to disclose potential conflicts of interest in writing and that does not require them disclose the percentage or amount of commission its members may receive from the sale of insurance products with opaque commissions.

- The CFP Board’s long, uninterrupted history of putting its own interests ahead of the consumers makes it decidedly unqualified to govern the financial planning profession. [Note: The CFP Board openly states that its primary objective is to make the CFP® mark a regulatory requirement for anyone who provides financial planning guidance. This would make the CFP Board the de facto regulator for the profession.]

- The CFP Board Claims to have weeded out the bad apples in the wake of the Wall Street Journal expose and trumpeted its expulsion of nearly 40 members (most of whom had already left the industry). There are hundreds (perhaps thousands) of CFPs with regulatory disclosure histories that would make Bernie Madoff blush who are still endorsed by the CFP Board as clean.

- The CFP Board’s latest dues increase to fund its marketing efforts and executive salaries highlights the danger of making the Mark the standard for the financial planning profession. Salary is excessive, compensation consultant appointed by the CEO, Keller earned $1,009,329 as disclosed on the Form 990 for 2020.

- In 2020, total disciplinary actions taken was 84, as per the CFP Board Form 990. Given there are 92, 814 certificants this is 0.1%

- The CFP Board has specifically stated that it wants the CFP® mark to be a requirement for anyone who practices financial planning.

Here is how the debate unfolded, point by point.

#1 Are you a superior advisor because you got the CFP designation?

Wright holds the CFP designation, while JR and Salaske do not.

Salaske says that having the CFP designation was never a requirement in anything he did to advise clients. He didn’t see the credential as attractive because by the time he was considering it, he had extensive real-world experience working with clients. He sees it as a testing exercise and doesn’t feel parts of the curriculum are that relevant. However, he did see it as a benefit (when he was looking to hire someone) if a young or inexperienced employee was getting the CFP designation. However, he would not require it.

Wright is an instructor for the College of Financial Planning in addition to being a CFP® certificant. He is very much an advocate for the marks and the education that comes with it. Wright agrees with Salaske’s point that experience trumps everything. According to Wright, it’s more than having to pass a test – there are CFP® certification requirements pertaining to education, quizzes, modules, etc. On the other hand, the FINRA requirements are just taking an exam – Series 7, 66, etc.

Salaske bristles at the fact that attorneys (and CPAs, by the way) can take the exam with certain programs such as Challenge Status, allowing them to bypass certain educational requirements. Wright agrees with Salaske that bypassing education shouldn’t be allowed.

JR, a financial planner, thought leader, and self-proclaimed zealot for this cause, says he does not denigrate the value of the CFP curriculum. He even pays for certain employees to go through the program. For JR, his issue is with the CFP Board and its conduct relative to consumers – not with the curriculum.

#2 The CFP vs SEC – who regulates better?

Wright says, if we are going to asset that the CFP Board and marks are bad, we should ask the question, “bad compared to what?” If we are comparing them to the Utopian idea of what a fraternity of ethics and competence testing should be, then we should find a way to implement it because daydreaming about what it ought to be is less useful. However, if we are comparing the CFP Board to existing agencies for ethical and competence testing, then he rules in favor of the CFP Board. The most important thing the CFP Board does not do is coerce advisors to participate which makes it superior to the SEC and FINRA.

JR argues that it is a big part of the CFP Board’s stated objective is to make the CFP® mark for all whom call themselves financial planners. And that move would make the CFP Board the de facto regulator of the profession. Anyone who uses the term “financial planner” must be registered with the SEC and held to their standard of conduct as a fiduciary under the Advisor’s Act of 1940.

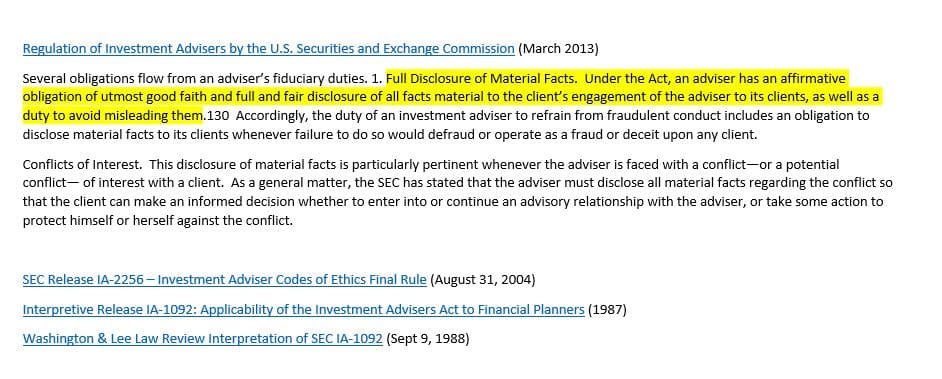

The SEC’s fiduciary standard and code of conduct, when compared side by side with the CFP Board’s code of conduct, you will find that the CFP Board’s code of conduct is carefully worded to be less restrictive than the existing fiduciary standards for the SEC under the Advisor’s Act. He assigns the term “faux fiduciary standard” to the CFP Board’s standards.

Wright retorts back that restrictions don’t necessarily mean higher ethical standards. To that, JR explains that the reason why the securities industry is regulated, as opposed to having a professional organization guide it, like the AICPA or the Bar Association, is that what the SEC regulates is securities. Securities are a product that must be regulated. JR argues that both in terms of enforcement and the requirements of the standard, the SEC’s standard is much higher than the CFP Board’s.

Wright feels that the SEC should be gone, and that the CFP should be a standard. He would like to see several competing agencies to exist as well. He feels that a fraternity of ethics and competence testing is far superior to a government agency that has no interest in justice.

#3 Are the CFP Board’s disclosure requirements too light?

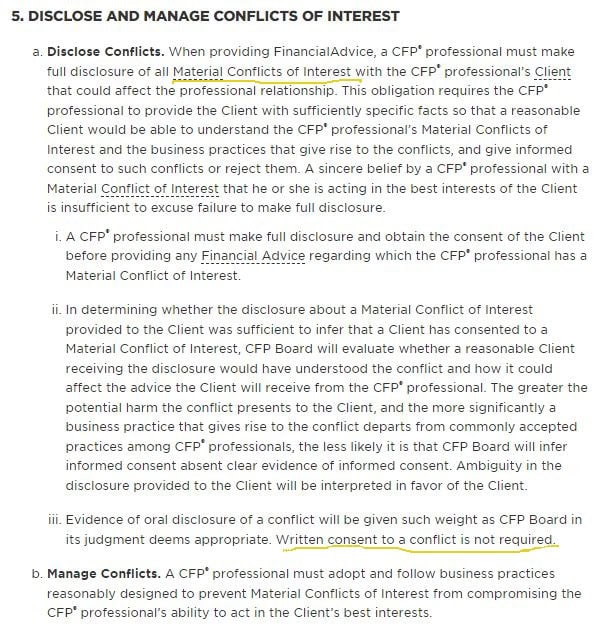

According to JR, the CFP Board’s “faux fiduciary standard” was carefully written to allow advisors to not have to disclose insurance commission they may receive, or opaque commissions in general. Their wording is “material conflicts of interest in general” vs the SEC’s standard that financial planners must disclose “all material facts.”

Wright contests that it may be deliberate but that does not make it unethical. There is nothing wrong with selling insurance.

But, JR asks, why can’t you make it so that financial planners who have the CFP designation have to disclose every penny they earn, up front and in writing, especially from an opaque source? Very simply, the dollar amount and the percentage in writing – why don’t they require that? He feels consumers would benefit from that immensely.

Wright responds that according to Section 8.5 of the CFP Board’s standard of conduct, that planners must “disclose and manage conflicts of interest and even suggest that a CFP® professional must adopt and follow business practices reasonably designed to prevent material conflicts of interest from compromising the CFP professional’s ability to act in the client’s best interest.

JR finds this wording to be vague and ambiguous. He says that in the CFP Board’s standard of conduct it states unambiguously that all CFP designation holders must voluntarily disclose all prior misconduct, any disclosures that may be on their FINRA or SEC IAPD records – and, as revealed in the 2018 Wall Street Journal expose, nobody did it (Zweig, Fuller).

Grillo pipes up that the CFP Board is never going to require compensation methods to be disclosed, because that would go against the insurance agents. JR agrees, stating that 70% of CFP holders have insurance licenses.

#4 Has the CFP Board failed to address the insurance problem – the “third hat”?

JR asserts that anyone who holds themselves out as a financial planner, whether or they wear dual hats, or also are registered reps under FINRA, must follow the fiduciary standard. However, the problem is that the SEC’s reach only extends to securities. Since 70% of CFP® mark holders have insurance licenses, anything they do on the insurance side (outside of variable products) is not regulated by the SEC. Financial planners do not need to act as a fiduciary when selling insurance as long as the product being sold is not a variable product. Hot selling, high opaque-commission products, such as index annuities and index universal life policies are beyond the SEC’s reach.

Insurance is the “third hat” and it’s a big problem. The SEC does not have a solution for this, argues Wright, to which JR responds that they can’t because it’s not their agency. Why not doesn’t the CFP Board address this with their members he asks? In fact, the CFP Board balked at requiring planners to make disclosures in writing.

JR and Wright agree that the CFP Board could impose fiduciary standards on the sale of non-variable insurance products. However, Wright feels that the wording under Section 8.5 is enough and that JR is splitting hairs.

#5 Is the CFP designation just a marketing credential?

Salaske feels that if the CFP Board were that interested in full disclosure, they would have a mechanism on their website whereby all CFP® certificants would have to disclosure all ways they receive compensation. But, they don’t.

According to Salaske, imposing such disclosure requirements would limit the money-making machine that they’ve created. Salaske says you would practically have to be a convicted felon for them to strip you of the mark; they want high numbers so they can collect their revenue and chest pound about membership. Many people use the CFP designation just to market themselves and the CFP Board is complicit in that behavior.

JR adds that Ben Coombs, one of the first CFP® certificants, very candidly stated in an interview that the members of the first CFP class were all insurance salespeople. They wanted to become credible to compete with the brokerage people when selling Master Limited Partnerships and insurance with financial planning credibility, so they got the designation. The designation has its roots in the insurance industry.

In 2003, there was a well-known financial planner and radio personality named Bradford Bleidt, JR continues, who ran at $30MM Ponzi Scheme. He admitted to getting the CFP designation for marketing credibility so he could build trust with people and then defraud them.

Salaske adds that every time the CFP fees go up, on social media there is a big outcry but they still renew because they are using it for marketing purposes.

#6 Does the CFP Board market the CF designation in a way that is misleading to consumers?

JR asserts that it is misleading to consumers to suggest that the CFP Board is a higher regulatory standard than the SEC. Despite the incidences mentioned in #5, the CFP Board has spent millions in advertising telling consumers they should always trust a CFP® professional and if they don’t have the CFP designation you just don’t know about their integrity. JR feels this is harmful to consumers.

#7 What about endorsing CFP® certificant bad apples as being “clean”?

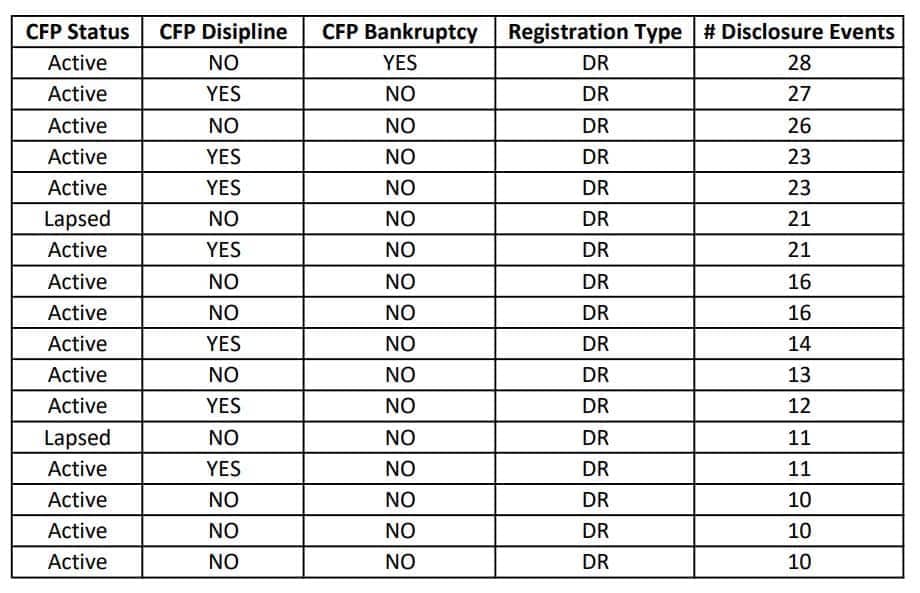

After the 2018 Wall Street Journal article, it was revealed that thousands of CFP designation holders did not disclose to the Board what their disclosure history was, and the Board did not bother to check (Zweig, Fuller). Yet even after this scandal, those six thousand CFP® certificants with disclosure marks are still showing up on the CFP’s website as having no disclosures.

To quote JR, “There are people with disclosure histories that would make Bernie Madoff blush.” The CFP Board has done nothing to protect consumers from those people. The CFP Board claims that CFP® certificants are thoroughly vetted – they’re not. In fact, there are some certificants with as much as 26 disclosure marks on their record – too much to be bad luck. JR claims to have a list of 200 CFP’s who have multiple disclosures (here are some examples below).

Wright argues that context is everything and that advertising on its own does that create harm. He uses the example of Doritos advertising during the Super Bowl.

#8 Is the CFP Board the financial institution equivalent of North Korea?

JR agrees with a Don Trone statement from a ThinkAdvisor article, “If the CFP Board were a country, it would be North Korea” and he feels that such statements regarding the Board’s lack of transparency with respect to executive compensation, the amount of money spent on advertising, and the amount of money spent on furthering its interests via lobbying politicians are useful in raising consumer awareness to protect them from being preyed upon.

Wright refutes Trone’s rationale for the North Korea analogy:

- There are no open elections for directors. According to Wright, democracy is not a sign of ethical behavior.

- Directors are required to sign confidentiality agreements. Wright feels this makes sense and makes them more ethical.

- Any conversation with a director requires the presence of a senior staffer. Wright feels this is an assertion rather than evidence of unethical behavior.

- Board minutes are not be made public. Why should they be, asks Wright, this is a private institution.

#9 Is there enough disciplinary enforcement?

It was reported in the CFP Board’s 2020 Form 990 that there were 84 disciplinary actions taken against members. With 92,814 members, this is a very small percentage (CFP Board, 2022).

Wright says if there were more disciplinary actions taken, people would use it as evidence of bad ethics running rampant.

JR says he has an issue with the CFP Board being critical of the SEC’s enforcement capability. He is willing to bet that out of the 82 actions taken, all of them were initiated by the SEC or somebody getting arrested (rather than proactive enforcement by the CFP Board).

Wright argues that the SEC is supposed to be an arm of justice but most of the time they end up litigating, or settling. They let Madoff get away with it after being told.

#10 CFP Board CEO makes over $1MM a year. Is that too much?

According to the 2020 Form 990, CEO Kevin Keller earned $1,009,329 in total compensation. Grillo feels this is excessive and that it’s unfair that at the same time they just raised fees by $100 for all certificants, many of whom are starting out in their careers when money is tight.

Wright says that salary is negotiable, is a matter of opinion, and shouldn’t be judged as unethical.

Surprisingly, JR says that Keller is doing a better job than many more before him in terms of leading the Board politically. Noteworthy to say, though, JR points out that Keller’s success in growing the CFP Board’s membership and public recognition of the CFP® mark are the primary task he was hired to do. Protecting consumers is not in his job description.

Grillo rebuts back that when she hears middle to low-income people on the playground talking about how great it was that a CFP® professional came into their work and did a free community presentation, she’ll feel Keller’s salary is justified.

#11 Has the CFP Board lost their mission?

Salaske says that the CFP Board is not looking out for investor interests; they are looking out for their own interest and doing that via growing their membership, having minimal enforcement actions and raising dues; none of which is in the consumer’s best interest. It’s not doing the public any good by stripping away fee disclosures in order to placate all kinds of compensation methods and conflicts of interest.

Wright says this is a false dichotomy, and asks Salaske if growing his business is not in his clients’ best interest. He says it also benefits clients.

Salaske comes back by saying that it shouldn’t be growth for growth’s sake. It shouldn’t mean sacrificing the mission that they are trying to accomplish.

Wright answers back that growth is not an indication of unethical behavior. You can grow your organization and take care of your clients at the same time and it may even be causative.

Sara’s upshot on the CFP Designation

What’d ya think of my blog and podcast debate on whether or not the CFP designation is worth it? Was this helpful in clarifying the role that the CFP Board plays vs. what it theoretically should?

I’m super grateful to my guests on this show. By the way, this show is Part One of a two part series. In Part Two of this CFP debate, we explore the role that the CFP Board should or should not play in policing financial advisor misconduct.

Hope you’ll tune in for that, too!

And before we say goodbye, some of you may be in growth mode and if you’re looking to grow your business on social media ethically…

- I am an outsourced CMO for companies who need regular, full service marketing – blogging, social media posts, newsletters, etc.

- I am an hourly consultant for those who just need one-time or recurring guidance

- People hire me as a ghostwriter to write content for a project fee

- I have a social media training program

- I have a book about what to say on LinkedIn messenger

Just letting ya know, in case you need me at some point.

Thanks for reading. I hope you’ll at least join my newsletter about financial advisor lead generation.

See you in the next one!

-Sara G

Disclaimers

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use, or the success of any program. The opinions expressed herein do not necessarily represent the views of Sara Grillo or Grillo Investment Management, LLC. Nothing in this podcast or blog can be interpreted as legal or compliance advice. For advise on such matters, contact a legal or compliance advisor.

There are no guarantees that any information presented in this article is accurate. Grillo Investment Management, LLC will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor. Any similarities to persons deceased or alive are entirely coincidental.

About Robert Wright, CFP®

Robert Wright, CFP® serves as a Financial Consultant with over 10 years of experience in the financial planning and services industry. Robert works directly with settlement planners and the families they work with to develop comprehensive financial plans.

Prior to joining Advocacy Wealth Management in 2022, Robert served in a variety of positions at Fidelity Investments and Morgan Stanley as a Financial Consultant.

Robert completed His Undergraduate Degree at The University of Utah in Economics and his Master of Science in Advanced Personal Financial Planning at Kansas State University. In addition to his formal Education Robert Wright holds his FINRA Series 7 and 66 licenses, is a CERTIFIED FINANCIAL PLANNER™ Professional and holds Georgia Resident Life and Health Insurance. Robert is also an Instructor of CFP® Coursework for the College of Financial Planning Online and on Campus at Kennesaw State University.

Robert is the father of three amazing children: Macie, Liam, and Charlotte; and husband to Priscila Moraes-Wright since 2012. He and his family love to play baseball, swim and play at the Georgia lakes and beaches.

About Scott Salaske

Scott Salaske is the founder and CEO of Firstmetric, a flat fee financial advisor firm in Troy, Michigan. Ever since the beginning of his 20+ year long career, Scott has pursued his mission of delivering high quality financial advice in a low cost and unbiased way.

Early on in his entrepreneurial journey, Scott saw firsthand the inherent flaws and conflicts of interest in the traditional sales and product driven approach, as several family members had lost a significant portion of their hard-earned life savings to high-cost, commission-based investment products and inappropriate advice.

It was at that point Scott thought there had to be a better way for investors to obtain unbiased advice and low-cost access to the financial markets. That lead him to start Quest Asset Management, with the novel idea of putting investor interests first as a fiduciary, which was practically unheard of at the time. The idea centered on the concepts of simplicity, keeping total investment costs and taxes extremely low and developing a custom investment plan for each client using low-cost asset class and index funds.

A few years later Scott merged Quest with another local investment advisory firm, Portfolio Solutions, that shared the same investment principles at that time. Several years after the combined merger, Scott went on to grow the combined firm from advising approximately $60 million in client investment assets under management to more than $1.4 billion. In early 2015, Scott sold his ownership interest in the firm. He started Firstmetric a few years later.

At Firstmetric, Scott continues his mission of delivering low cost, unbiased advice to clients. Along his journey he has been quoted in the following publications: The Wall Street Journal, Investor’s Business Daily, Kiplinger’s Retirement Report, TheStreet.com, Cheddar.TV, Crain’s Detroit Business and MarketWatch.com; among others.

About John “JR” Robinson

John (J.R.) holds a degree in Economics from Williams College and has been a financial advisor since 1989. Research papers he has written on a broad range of financial planning topics have been published in numerous peer-reviewed academic and professional journals. Papers he co-authored on retirement income sustainability won the 2008 and 2010 Certified Financial Planning Board of Standards and International Foundation for Retirement Education Best Paper awards, respectively. His co-authored paper, The Determinants of Nest Egg Sustainability, was a Finalist in the Journal of Financial Planning’s 2016 Academic Research Competition and appeared in the May 2017 issue of that journal.

John is recognized as a thought leader for the financial planning industry, particularly on ethical and regulatory issues facing the profession. His commentary regularly appears in the nationally syndicated news media. In 2019, he helped develop a front-page story in the Wall Street Journal that exposed how the CFP Board of Standards was promoting more than 6,000 CFPs with major regulatory disclosure events (including criminal conduct) while running a multi-million dollar advertising campaign telling consumers that its CFP members are thoroughly vetted and more trustworthy than non-CFP SEC-registered financial planners. John has twice been included on Investopedia’s list of the top 100 most influential financial advisors in the U.S.

He is also a co-founder of Nest Egg Guru, a maker of affordable, client-facing software for financial advisor websites. Nest Egg Guru’s flagship app suite is designed to help engage and educate clients by stress-testing their retirement savings and spending strategies. Nest Egg Guru has also rolled out a unique password management app and a separate secure file-sharing app that financial advisors may offer as a free service to their clients to build loyalty and strengthen relationships. Both of these apps are available for use by Financial Planning Hawaii clients as well.

Most importantly, John holds dear the loyal, lasting relationships he develops with clients. He adamantly believes that the clients’ interests must come first and is constantly seeking new ways to add value to the families he serves.

Sources

Accountant-Lawyer Alliance. The ALA Has Partnered With Kaplan To Provide Certified Financial Planning Review Materials In A Cpe/Cle Course Format. https://alacommunity.org/cfp-challenge-candidate/

Certified Financial Planner Board of Standards, Inc. (2020). Return of organization exempt from income tax [Form 990]. Public Disclosure Copy. City: Washington, DC. www.cfp.net

CFP Board. Code of Ethics and Standards of Conduct. https://www.cfp.net/ethics/code-of-ethics-and-standards-of-conduct

CFP Board. (2022, August 1). CFP® Professional Demographics. https://www.cfp.net/knowledge/reports-and-statistics/professional-demographics

CFP Board. Verify a CFP® Professional. Verify an individual’s CFP® certification and background. https://www.cfp.net/verify-a-cfp-professional

Financial advisor U4’s

FINRA BrokerCheck. https://brokercheck.finra.org/

Kitces, Michael. (2018, July 24). Nerd’s Eye View. #FASuccess Ep 082: Insights From The History Of Financial Planning Since The First CFP Class with Ben Coombs. https://www.kitces.com/blog/ben-coombs-podcast-history-financial-planning-first-cfp-class/

SEC IAPD. Investment Adviser Public Disclosure. https://adviserinfo.sec.gov/

Trone, Don. (2017, July 11). ThinkAdvisor. ‘Just Say No’ to CFP Board’s New Standards. https://www.thinkadvisor.com/2017/07/11/just-say-no-to-cfp-boards-new-standards/

Weisman, Robert. (2009, January 20.) Boston.com. An earlier Ponzi pain lingers. http://archive.boston.com/business/articles/2009/01/20/an_earlier_ponzi_pain_lingers/

U.S. Securities and Exchange Commission. (2013, March). Staff of the Investment Adviser Regulation Office. Division of Investment Management. Regulation of Investment Advisers by the U.S. Securities and Exchange Commission. https://www.sec.gov/about/offices/oia/oia_investman/rplaze-042012.pdf

U.S. Securities and Exchange Commission. 17 CFR Parts 270, 275 and 279. [Release Nos. IA-2256, IC-26492; File No. S7-04-04] RIN 3235-AJ08. Investment Adviser Codes of Ethics. Final rule. https://www.sec.gov/rules/final/ia-2256.htm

U.S. Securities and Exchange Commission. [Rel No. I092] Applicability of the Investment Advisers Act to Financial Planners, Pension Consultants, and Other Persons Who Provide Investment Advisory Services as a Component of Other Financial Services. https://www.sec.gov/rules/interp/1987/ia-1092.pdf

SEC Release 1092 on the Investment Advisers Act of 1940: Applicability of the Investment

Advisers Act to Financial Planners and Other Persons Who Provide Financial Services, 45 Wash.

& Lee L. Rev. 1139 (1988). Available at: https://scholarlycommons.law.wlu.edu/wlulr/vol45/iss3/10

Zweig, Jason, and Fuller, Andrea. (2019, July 30). Wall Street Journal. https://www.wsj.com/articles/looking-for-a-financial-planner-the-go-to-website-often-omits-red-flags-11564428708