Podcast: Play in new window | Download

In this blog-pod, you are going to hear four Linkedin social media tips for broker dealer representatives and highly-regulated financial advisors. If you are a financial advisor under tight compliance regulations who wants to get new clients and leads using LinkedIn and other platforms, there is hope. But you’ve got to make smart decisions.

You’ll learn:

- What you need to stop doing ASAP to avoid damaging your status on LinkedIn

- Two types of postings to use on social media

- One lead getting techniques that many broker dealer reps have used to successfully get meetings on LinkedIn

- One bonus tip that will potentially can raise financial advisors’ social media success rates

For those of you who are new to my blog/podcast, my name is Sara. I am a CFA® charterholder and I used to be a financial advisor. I have a weekly newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.” So please subscribe!

How financial advisor branding is different for broker dealer and wirehouse reps

Financial advisor branding is a bit different if you are a broker dealer rep at a place such as Morgan Stanley, Merrill Lynch, Wells Fargo, UBS, or Edward Jones, to name a few.

When you signed up to be a financial advisor at one of these places, you were signing up to be a part of a huge brand. This has many benefits. When you walk into a room and tell someone you work at a place like this, they’ll probably know what it is. It conveys more security than if you uttered some name the person didn’t recognize.

However, there is a bit of an exchange that has happened when you agreed to do this. You are exchanging brand for brand. You’re giving up a little bit of your brand equity in exchange for some of theirs.

There isn’t the opportunity to build a huge financial advisor brand if you are at a wirehouse the same way it would be if you were an independent RIA firm.

Don’t sweat it, financial advisors.

That doesn’t have to get in your way, and it certainly doesn’t mean you can’t get clients over social media. There are fewer options to choose from, but it’s all about how you execute. If you execute wisely, you can get meetings, leads, and new clients from social media despite the severe restrictions you face.

I’m about to tell you how.

Let’s do this!

Linkedin Social Media Tip – What financial advisors should stop doing

Many of you are posting the canned crap content that your wirehouse is giving you. Come on, people.

Stop posting articles or any type of link to a third party website that takes the viewer away from LinkedIn or any other social media platform you are on.

STOP RIGHT NOW.

PULL THE PLUG RIGHT NOW.

To clarify, no more direct links in the posting, people!

LinkedIn is going to BURY your content.

Understand this: most social media sites make their money off people who pay them to advertise on the platform. To them, time on the platform is the currency they are paid in.

- LinkedIn loves anything you do to make people spend more time interacting on their platform, and they will reward you by giving your content more visibility in the feed.

- LinkedIn hates anything you do to make people spend more time outside their walls.

If you are posting third party articles that direct the audience away from LinkedIn, you are telling LinkedIn that you do not respect their business. They will pay you back in kind by saying, “Shame on you! Okay fine, be that way! I’m going to show your posting to a small percentage of people in your network, and THAT IS IT.”

This is how and why LinkedIn buries your content if you put links in your postings.

In addition, the other thing LinkedIn hates is duplicated content. If you are posting the same article that 50,000 other UBS reps are, LinkedIn gets worried that people have already seen it somewhere along the line. They’ll bury it for that reason, too.

So, now do you see why you have to change your strategy?

Let’s talk about what you need to do.

Two types of social media postings that highly-regulated broker dealer and wirehouse reps should use

Keep it fun, light-hearted, and cool. Make it easy for people to want to engage with the post. Don’t try to be the smartest person. Generally people don’t care about how much you know; they want to be entertained a little bit.

The more comments you get, the more time you are making people spend on LinkedIn and remember LinkedIn loves that. Ask yourself, “what do I need to say to get people commenting” instead of “what do I need to say to get a meeting or set up the case to sell an annuity.”

There are specific things you can do to get more people to comment on your posts. This is exclusive material, so I don’t give it away for free. But if you want to be in the know about this and other LinkedIn tips for financial advisors, please join my membership.

For starters, try these types of posts. They have higher potential to engage because they are cool, light-hearted, and fun. Your compliance officer will love them (probably)!

The text only posting

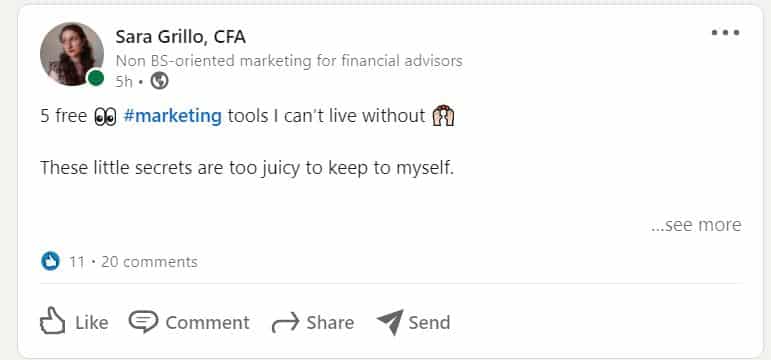

Don’t get too technical. Just tell a story or give some quick info. Here’s a text only posting that I recently did. You can see it got super engagement after only a few hours.

See? Cool, fun, light-hearted.

And most of all it was super helpful and gave practical tips people could use right away.

The selfie post – Linkedin Social Media tip for the win

Selfie photos are impromptu, informal and super fun. Everything the opposite of what a financial advisor typically is.

DO IT.

Here is a pod-blog about selfie photos for financial advisors, with several examples of great selfie postings that did great on LinkedIn.

Cool, fun, light-hearted. Throw on a quick caption and send it to compliance.

One lead getting technique that has worked for many broker dealer and wirehouse reps

Most wirehouses and broker dealer firms permit their reps to send LinkedIn messages. But they have to make you look like a high quality financial advisor and you can’t sound like a washing machine salesperson which is how many of you sound unfortunately.

I’m going to tell you a story about an Edward Jones rep who was on my membership. The pandemic hit and he couldn’t meet people in person anymore. He didn’t know what to do. I told him to get on LinkedIn messenger and start talking to people and I gave him some messages to send. He was setting up meetings left and right and did very well for himself. Now, this is no guarantee of what your potential experience may be, but it does show you how powerful LinkedIn messenger can be for a person who is thoughtful and careful about what he or she writes to people.

One bonus Linkedin Social Media tip that can potentially increase financial advisor social media success rates

Here’s an extra social media tip.

Take down the frequency, and take up the thoughtfulness.

Understand that if the post is not getting engagement, it’s hurting you. If it is not working for you, it is working against you.

Every posting, you should look and say:

- What worked

- What needs to get better

- Come on, what do I do differently next time

Quality not quantity, folks. Look at each post as an engagement and look to improve each time. This takes time, but it will be time well spent. I’m okay with you doing one post a month if that’s what it takes to get higher engagement.

Sara’s Upshot on LinkedIn social media tips for highly-regulated and wirehouse broker dealer reps

What’d ya think? Was this helpful?

If yes…

Learn what to say to prospects on social media messenger apps without sounding like a washing machine salesperson. This e-book contains 47 financial advisor LinkedIn messages, sequences, and scripts, and they are all two sentences or less.

You could also consider my financial advisor social media membership which teaches financial advisors how to get new clients and leads from LinkedIn.

Thanks for reading. I hope you’ll at least join my weekly newsletter about financial advisor lead generation.

See you in the next one!

-Sara G

Music is Nice to You by the Vibe Tracks

Sources

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use, or the success of any program.

The company will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor.

Nothing in this article or podcast can be construed as legal or compliance advice. For advice about complying with your company’s regulations regarding marketing-related activity, please consult your legal or compliance officer.