Maybe you have just started out in the wealth management industry seeking to set up some salary goals for yourself. Or perhaps you are a veteran financial planner who is looking to benchmark your pay versus the industry. Or maybe somewhere in between…The subject of how much Financial Advisors get paid is often a confusing one and the topic is devoid of much accurate information.

In this blog you will learn what the available research says about:

- How much money financial advisors make

- How profitable is a financial planner

- What is a good financial advisor salary

- How to maximize your compensation as a financial planner

- How you can make your financial advisor practice more profitable so you can take home more of what you earned

By the way, thanks for joining me.

For those of you who are new to my blog/podcast, my name is Sara. I am a CFA® charterholder and financial advisor marketing consultant. I have a weekly newsletter in which I talk about financial advisor lead generation and practice management topics.

Also, I publish exclusive content on LinkedIn marketing for financial advisors.

So if you’re looking for some straight up talk then you’ve come to the right place!

How much does a Financial Advisor earn?

One of the reasons that this question is such a nebulous one to answer is the lack of clear information, even from the major reporting services.

The Bureau of Labor Statistics has some ‘interesting’ numbers. I had to do some digging to actually answer the question of financial advisor salaries. According to the BLS, the median annual wage for personal financial advisors was $87,850 in May 2019.

But, how true is that number? In that same source, I found:

- 10% of financial advisors make less than $42k… WTF!

- Only 10% of financial advisors make more than $208k? Say WHAT?

Actually, in my opinion (and my ten plus years of experience) it probably looks more like:

- A good salary is $150-250k per year, after you pass the entry level.

- Someone starting out may earn between $30k to $80k starting salary.

- Lastly, from my experience, I have found it is not uncommon for them to earn more than $250k.

By the way, if you’re looking to build your practice, LinkedIn prospecting is something you should consider. Check out these LinkedIn messages for financial advisors. I also publish weekly tips in my newsletter on this and other financial advisor marketing topics.

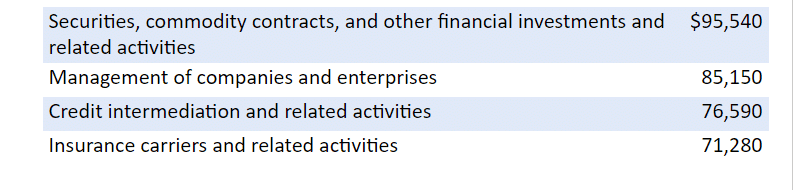

Let’s dive into this a little more. Below I am going to show you some data from the Bureau of Labor Statistics. This is what the BLS is saying about “personal financial advisors” as of May 2019:

I have doubts about this figure being accurate – I will explain why in a minute – but first off I want to say that I am not sure exactly how they are defining this term. As you can see pretty nebulous – like “credit intermediation”?

Hello?

What does that even mean?

Check out my e-book which helps Financial Advisors meet new clients over LinkedIn and other social media sites

50% OFF this month ! USE CODE ebooknow

Financial advisors are not credit intermediaries

Its dubious to me that this financial advisor salary data is accurate because these are not the terms that financial advisors use to define themselves. And it’s unclear what this term “credit intermediation” even refers to. Most financial advisors want nothing to do with helping people get out of credit card debt. Is that what they mean? Or are they talking about lending, about providing a line of credit almost as an investment banker does.

Can we really be sure the BLS is tracking financial advisor salaries, as we define them (the person who helps you with your IRA rollover) with these numbers? It does not seem like it.

“Securities, commodity contracts, and other financial investments and related activities.” This sounds more like a portfolio manager, investment manager, hedge fund manager, or trader. This does not sound like the typical job description for a financial advisor, the person who helps people retire and send their kids to college.

“Management of companies and enterprises.” Is that like a CFO?

But nonetheless:

10% of financial advisors earn less than $42k? WTF!

The BLS states

The median annual wage for personal financial advisors was $87,850 in May 2019…The lowest 10 percent earned less than $42,950, and the highest 10 percent earned more than $208,000.

Source: Ibid

Whoa, whoa, whoa. How can this be accurate?

First of all, if it’s less than $42k, they are probably a junior advisor of some sort. It is good that the BLS is using median instead of mean, because that may have helped decrease some of the skew to the left tail. At least they got that part right.

Junior financial advisor pay is probably skewing this measurement

But let us be real for moment. When we ask how much wealth managers make, we are not really interested in how much junior (associate) advisors earn.

- That is because junior advisors may or may not be licensed, and even if they are, they are not really fully in relationship development mode.

- They are not out there at the Chamber of Commerce meeting reeling in new people to sell whole life insurance to. This really caps the upside of their compensation.

- Once a junior financial advisor does start to accumulate clients they probably become promoted to be senior financial advisors, and that is the point where they start earning the higher salaries. And good for them, because making $40k a year here in the US is a tough way to live!

- Low salaries are unfortunately the reality at many of the smaller financial advisor practices, though, and I have outlined some solutions for how to escape what I call the small RIA firm poverty trap.

Whether the salary is low due to newness to the industry or other factors such as firm size isn’t my point, though. I was trying to convey that I feel that in their analysis the BLS really should have separated out junior financial advisor pay from this reading.

Only 10% of financial advisors earn more than $208k? Say WHAT?

I also have doubts about the accuracy of the statement that “The highest 10 percent earned more than $208,000.” The BLS says that they did not include bonuses when they surveyed financial advisors who work at firms as opposed to being self-employed. That definitely will take down the measurement a notch.

But wait a minute – they were able to find financial advisors who work on salary? How’d they do that? I’m dying of curiosity.

Please tell me, all of you who are familiar with this industry, who the heck offers their financial advisors a salary? I have heard of Buckingham Strategic Wealth and Edward Jones paying a salary, and that is it.

A financial advisor is a salesperson and we all know that salespeople get preeeeeety lazy and complacent when you give them a salary. It would be interesting to see how many of the financial advisors surveyed about their compensation were paid on salary as opposed to getting paid the “old fashioned way” – eat what you kill (like most of the industry does!)

I have found it is not uncommon for a financial advisor to earn more than $250k. And by the way, I doubt this line about only 10% of advisors making more than $200k is true. Because if it were true then there would not be many people wanting to actually be financial advisors. There are hundreds of thousands of financial advisors in the US. If this data were true, there would be maybe 20.

Many financial advisors are planning to retire on their book of business. Which prompts me to ask – what is your book of business worth? If your salary is less important to you than the equity in the business and its sale price, consider finding out how to value your financial advisor practice and/or contact a consultant to do so…preferably before it’s time to sell it and retire.

By the way if you are enjoying my fun and irreverent style in this blog, then please feel free to sign up for my weekly newsletter.

What is a good Financial Advisor Salary?

According to the BLS, the median annual wage for personal financial advisors was $87,850 in May 2019.

So here’s a better question. What is a good financial advisor salary?

If the median wage of Financial Advisors were less than $90k a year then that it is breadcrumbs in relation to the amount of liability you are taking and how hard you do have to work and keep up with your certifications. So, like I had mentioned, I’m going to take a minute and voice my opinion. This is based upon what I have seen in the industry over my ten plus years of experience.

I’ll talk about from two angles, what financial advisors with experience and an established book tend to earn. The other being what financial advisors earn when they are starting out.

- What is a good financial advisor salary? Given the amount of risk and liability you are taking by assuming this role, you should earn at least $150 per year after you pass the entry level.

- What do starting financial advisors earn? I have seen them earn between $30k to $80k starting salary. It depends upon how aggressive the firm wants them to develop new business.

Is Financial Advising A Good Career?

All of this begs the question, is financial advising a good career? Is it worth it being a financial advisor given the risk you take?

Some of these clients are such pains in the neck. In a bad market, imagine the stress of every single client calling you ready to fire you, and you have to talk them down from the ledge figuratively of course. And then in an easy market they want to hassle you on performance and say how they could have done it better in an index and following Cramer or CNBC, and what are you getting your fees for. Then they want you to act like their personal butler to make it up to them or something. It’s not an easy job.

Or even better, how even can financial advisors maximize the amount of money they make? How financial advisors earn more money?

Both of these topics I am going to address next. But first, I have a question for you. Are you enjoying this blog so far? If so, I encourage you to follow my podcast as well. In the podcast I focus on financial advisor lead generation and marketing, and I do it in a highly entertaining way just like how I’m entertaining you with this blog. Please subscribe here.

For example there was this one podcast I did about how most of you are breadcrumbing away your own financial advisor profitability. Please listen to it! In this podcast you can learn about:

- Why the typical ways that financial advisors assess their success are lacking, and what the best metrics are to evaluate the success of your business

- Running your business like a profit center not a sales office

- Working with fewer clients may be the best thing for your business. Consider how your service offering is impacting your profitability and potentially allowing you to become breadcrumbed – and what to do about it.

Remember that it’s not as much about how much revenue you make top line as it is about how much you take home. So let’s take a look at what financial advisors are making versus how profitable their practices are.

Earnings highly related to profitability

It is not selfish to be concerned about how much you are taking home and how profitable the practice is. I had a vendor to my own firm that he went out of business. He was someone I relied upon a lot and it looks like he could not sustain his business, and he went out of business, this was really harmful to me and my firm. It caused a little bit of confusion. Luckily I was able to take advantage of other resources but it was really not a good feeling.

You have people that are depending on you and the more profitable your firm is, the greater stability there will be and you can compensate your people, and the more value I think you can give that back to your clients. So, you are not being selfish in wanting to maximize your profitability, and having said that, it doesn’t mean you have to go about this in a self-serving way.

The question then becomes; how do I maximize my compensation as a financial advisor? But how do I do this in a way that keeps the client’s best interests in mind? And that is what I have sketched out and is what I am

going to look at.

Right here I am going to show you.

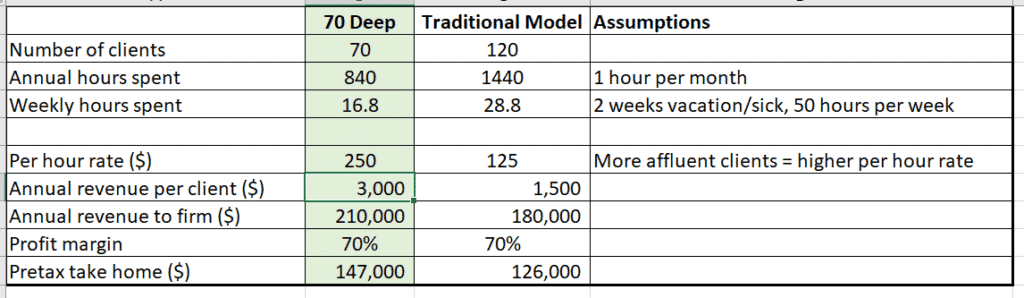

First let’s start by looking at the traditional model.

The traditional financial advisor profitability model stinks

Let’s say that a Financial Advisor is traditionally going to be having between 100-150 clients, let’s say you have 120, on an annual basis you are putting up about 1400 hours of work and on a weekly basis this comes out to around 29 hours a week. That’s a whole heck of a lot of hours, doesn’t mean too much time for that much else considering that you have the operational aspect of the firms, the administrative aspect and training to manage employees. All of this at a firm of this size it probably wouldn’t just be you, you would need some other support resources.

So this comes out to be a per hour rate of $125, not great on a per hour basis, annual revenue coming in at $180,000 and then the profit margin let’s say at 70%. Now this is assuming that you are an independent and you are not working at a big brokerage house and not a W2 employee because if so they are going to take a big pay-out.

Let’s say you are an independent, you have your own firm and you are getting 70% of your revenues taken home as your top line revenue. So this comes to pre-tax take-home of $126,000 assuming a 70% profit rate. After taxes, this is not that far off the BLS data.

It’s funny right? So funny I forgot to laugh.

The fact is that making this amount of money as a financial advisor stinks relative to all the stress you have to go through. Most financial advisors I know are running around like their hair is on fire. Wouldn’t you rather make more money without having to be like this?

I’ll tell you how. You’ve got to be able to create more profitable relationships. In the next section I’ll discuss how to plan this out.

A better paradigm for profitability: The 70 Deep Model

Let’s re-examine the financial advisor profitability chart.

At 120 clients in your practice is that really a comfortable practice? I mean you are making a living; your clients are getting a service, but wouldn’t you rather do what I am calling the ’70 deep’ model which would advocate for fewer clients but having much deeper relationships with them.

So, if you have 70 clients, let’s say they are larger clients, let’s say these are ultra-high net worth clients of maybe $2,000,000 to $5,000,000 portfolio size, you are spending 840 hours a year instead of 1400 because you are assuming 1 hour per month on each client. On a weekly basis you are spending much fewer hours than in the traditional model, your revenues are coming in higher because you are making more because you are having more time to spend on each client. This allows you to really delve in deep into some of the deeper, more sophisticated planning aspects. And like I said these are larger clients, so not only do they probably have larger asset base, but there is also more to do for each clients, and it all comes out that much better in terms of profit margin.

Let’s say that maybe you are taking home a little bit more. Again, this is not totally awesome but I would assume that as a financial advisor you would be wanting to make more than that. But it does allow financial advisors to make higher compensation because with 70 clients you can burrow down deeper.

When you get these 70 clients, you are providing more sophisticated services, you have the freedom

of time where you can then go up in asset size and get clients with even deeper needs.

Let’s say you created a strategy where you do this in a very deep, thorough and deliberate (careful) way, where you were very selective about who you worked with and you weren’t running around trying to scramble for the next client because you are deeply entrenched with these 70 clients here. They feel serviced you feel served. Less client turnover better for your practice, less for you to mentally be preoccupied with and then you can focus on getting even bigger clients. Your referrals will probably increase as well because with these 70 clients you have these deeper relationships and hopefully they could maybe pass on a word or two about you if you are doing a good job.

Financial advisors should increase value & profitability to increase earnings

So the point I am trying to make is here, financial advisors, is that it is overall a lot more advantageous for your compensation and the profitability of your company for you to use what I am calling the ’70 deep’ model, and for you to focus on fewer clients but really to maximize the value of what you are doing for them.

That means knowing them deeper, providing higher value and delivering more sophisticated solutions

that really make a difference in their lives.

It’s not to say that with more clients you would necessarily not be able to do that, but we all

have the same amount of hours in a week and if you do the math on it like I showed you in the spreadsheet, there quite simply isn’t enough mental time to focus when you have more clients that you need to take care of.

So in short what I am saying is to serve clients better, use the ’70 deep’ model and that will help you to maximize your compensation, the value of what you are doing for your clients and the overall profitability of your firm which will reward everybody in the long run.

Now how do financial advisors go about getting more clients (other than passively waiting for referrals to come in)? I’ll cover three major ways.

#1 Financial advisor LinkedIn messages can be used to get new leads

How can financial advisors reach new clients using the internet? The words you use convey your brand and this is critical for a financial advisor to get right. Are you sure your LinkedIn messaging is good enough? I wrote an e-book called, “47 Financial Advisor LinkedIn Messages and Sequences that will NOT make you look Stupid. “ If you are a financial advisor trying to meet new clients over LinkedIn or other social media sites and you need some scripts, you can download it here.

#2 Financial advisors can use other digital methods such as blogging, podcasting, etc.

In order get to the 70 Deep Model, you really need to have to break away from the typical ways that Financial Advisors communicate, and go about prospecting in a higher value way.

I have a membership program that teaches financial advisor strategies for using LinkedIn, Facebook, and Twitter for getting new leads. I also talk about how to relate your marketing and lead generation to certain financial advisor practice management topics.

I’m not going to say anything about any one service, but in other blogs I do outline my opinion of the various financial advisor lead generation services. My basic point is that these can be very hit or miss depending on which one you choose.

Sara’s upshot

What’d ya think? Was this helpful?

If yes…

Learn what to say to prospects on social media messenger apps without sounding like a washing machine salesperson. This e-book contains 47 financial advisor LinkedIn messages, sequences, and scripts, and they are all two sentences or less.

You could also consider my financial advisor social media membership which teaches financial advisors how to get new clients and leads from LinkedIn.

Thanks for reading. I hope you’ll at least join my weekly newsletter about financial advisor lead generation.

See you in the next one!

-Sara G

Sources

Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, Personal Financial Advisors,

Retrieved on the Internet at https://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm (visited October 25, 2020).