Podcast: Play in new window | Download

As the move to transparency in financial planning takes hold, regulations are changing in Colorado and other states. Here’s the triumph of virtue that financial planning transparency will (FINALLY) bring to planners across the country and the benefits to clients that come along with it. Get ready for an exciting show, folks, whoo hoooo!!!!!!

We welcome Dwight Dettloff, CPA, CFP, and Knut Rostad to today’s discussion.

Let’s get into it, folks! We’ll cover:

- What does it mean for financial planning to be transparent?

- What are the changes in Colorado investment advisor regulations regarding financial planning?

- What is happening in other states regarding reform of financial planning regulation, and why we expect these changes to become more widespread.

- What should financial advisors do?

The move to financial planning transparency is aflame!

The Transparent Advisor Movement’s mission is to promote ideals of:

- Clarity,

- Modesty,

- Integrity,

- Fairness,

- Logic, and

- Client advocacy

in all aspects of financial advice, with a special focus on Advice Only, Flat Fee, and Hourly service models. There is an emphasis on logical and clear disclosure of services and their related fees.

The goal of the Transparent Advisor Movement is to create the country’s best financial advisors – the most ethical, effective, and successful financial advisors that the industry has ever seen in its history. To do this, we are dismantling many of the norms and reconstructing them with a sheer focus on the experience of the end client, something that has never been done before.

Specific examples:

- Educating financial advisors of all business models (AUM, fee only, commission, etc.) about how to run a business with higher transparency to the client

- Executing outreach to college students to encourage them to avoid predatory wirehouse and insurance training programs and pursue fee-only paraplanning jobs instead

- Working with advocacy groups to influence policy, law and governance

- Mentoring younger advisors

- Matching up advisors one on one to be accountability partners and support each others growth

Today I have a few influential members of the Transparency Movement here with me and we are going to talk about the changes occurring within state legislature as this movement unfolds.

Knut Rostad is the president of the Institute for the Fiduciary Standard and fiduciary defender.

Dwight Dettloff, CPA, CFP® is the founder of Winding Trail Financial Planning in Colorado.

Financial planning changes on the minds of state regulators

With the rise of alternative fee models such as flat fee and advice only, there is an important discussion among flat fee and some AUM advisors about the relative benefits of each model. Within this context, regulators have started to raise their concerns related to alternative fee models than AUM.

There is an organization at play called NASAA (North American Securities Administrators Association). Their concern is to unify the state administrators and address what concerns them. They often come out with model rules, recommendations, and advocate for the states in Congress and at regulatory agencies such as the SEC. The issue of financial planning transparency has become important to NASAA based upon what their state regulators are finding in their examinations.

Colorado financial planning regulations are in reform

Colorado is a good place to begin when discussing the reform to financial planning regulations that is currently underway. Colorado regulators came out with a seven-page memorandum in March 2022 expressing their experiences and concerns about what their examiners have found from flat, fixed, and hourly advisors in their jurisdiction. They revised this guide in November of 2022.

Advisers regularly have questions on how they can be appropriately compensated for the ongoing work that they complete throughout the year. At the same time, Division Examination Staff (“Staff”) has found that many ongoing financial planners are unprepared to respond to Staff inquiries about fees and work performed made during regulatory examinations. In these instances, Staff has found advisers unable to produce documentation demonstrating the financial planner-provided services to clients, the detailed accounting of fee to work deliverables, itemized invoices as well as clear and detailed fee schedules. The Staff would like to work with advisers to assist them in developing a business model that better meets clients’ needs and complies with existing regulations.

-Colorado Department of Regulatory Agencies. Division of Securities. November 2022

What the essentially expressed concerns about what the extent to which they found that many advisors could not answer questions about the nature of the services being offered and the fees in total that are being charged. Regulators are trying to make sense of what they are seeing in these individual cases. Since March 2022, the CFP Board, Michael Kitces, the Institute for the Fiduciary Standard and the FPA, among others, have provided commentary on the memo.

Reform and the advent of higher financial planning transparency

What flat fee advisors represent is something new to the regulators and is clearly apart from what they have traditionally seen from the advisors in their jurisdictions who are charging AUM. It’s possible there are good faith misunderstandings as this set of services is unrelated to the management of investments which is their core competence.

Regulators, not just in Colorado but across the country, are seeking ways that there could be greater clarity in the disclosure and communication in the fees that flat fee advisors charge and what they provide. The primary disclosure document cited is Form ADV as opposed to an engagement agreement.

Regulators’ worries are justified

It makes total sense for regulators to have concerns about flat fee models, based upon the financial planning transparency movement being in its nascency and a potential lack of clarity existing.

One of their pressing questions is, how do we know that the flat fee is reasonable?

Let’s look at an example.

- If somebody has a $500k portfolio and we just use a standard 1%, they’d be charged $5k a fee.

- If you charge them a flat fee of $5,000, all of a sudden Colorado regulators (for example) would be asking, well what are you doing for them?

- If that $500k were a 401(k), not directly managed by the advisor (or let’s say that it were a business owner with no assets at all), the state would need to come in and ask if the fees the advisor is charging were appropriate.

It’s a lot easier for the state to find a 1% AUM fee reasonable because they can point back to the money the advisor is managing. There is a record of it. The assets are held at the custodian, the fee comes out, and the act of the assets being held at the custodian under your oversight implies that there was a deliverable (monitoring, rebalancing, etc.).

Some difficulty comes in here. With a flat fee, the fee may or may not come out of the assets held at the custodian. The services do not have the appearance of being directly linked to the fee, as they would be in the AUM case. The regulators don’t want an advisor charging $5k on a $100k portfolio because that is a 5% fee which is deemed unconscionable. They would never have approved a 5% AUM fee.

Given these types of scenarios, it’s understandable to see where the states, in the face of being confronted with flat fee advisors that they have jurisdiction over, would have a high need for transparency into what the advisor is charging, and what exactly they are delivering for that fee. It’s totally understandable to see where they are coming from.

How can advisors provide reporting that fulfills the transparency need

Whereas an AUM advisor would have an easy enough time answering the question to regulators of “What did you do last quarter for your fee?”, there is an understandable lack of clarity as to what the answer to that question is likely to be from a financial planner.

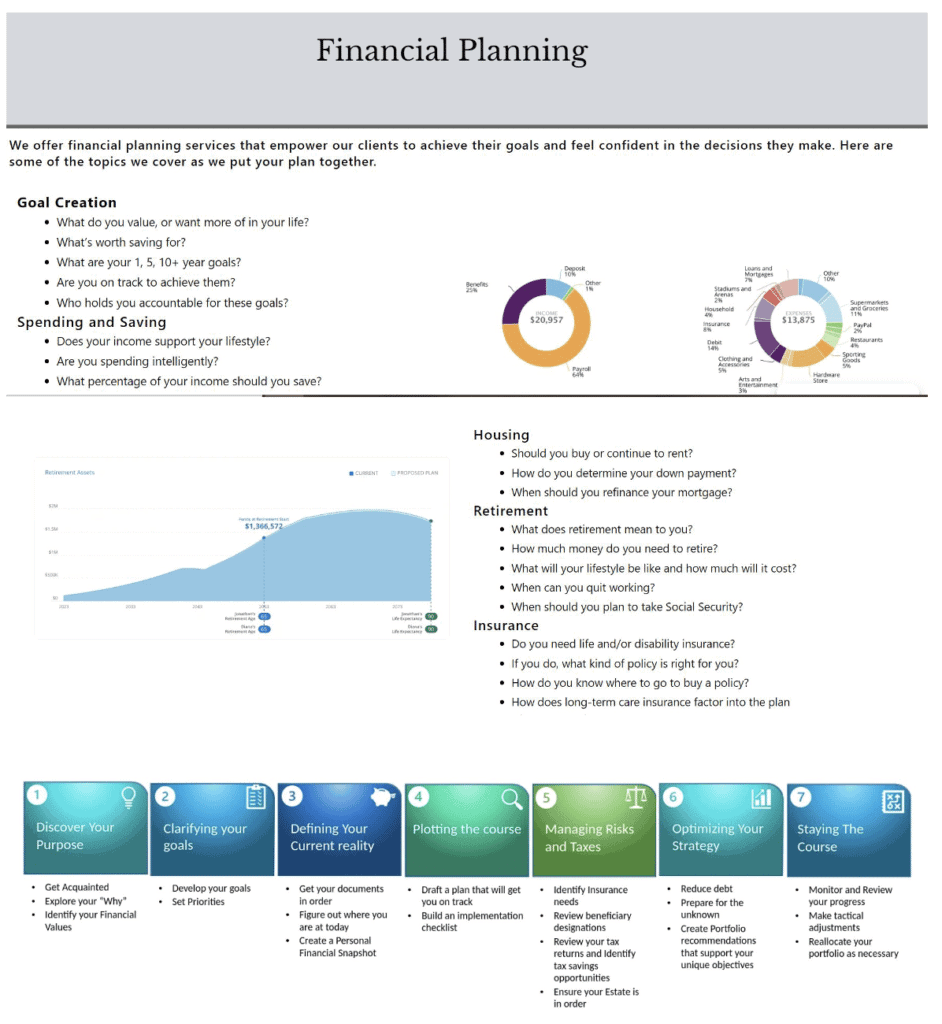

When you look at the range of what a financial planner could deliver it is broad. Some define it as a document, others as a service. The State of Colorado, in their memo, objected to use of the term “comprehensive financial planning” with no further definition to it. What does that mean? The term is not well defined.

Further, not every month is going to be as equally busy. This is a service that is driven by needs and wants in the client’s life. Some months will be busier than others.

Lodestar Financial Planning does a great job providing clarity about what their financial planning offering entails. This level of transparency is a step in the right direction.

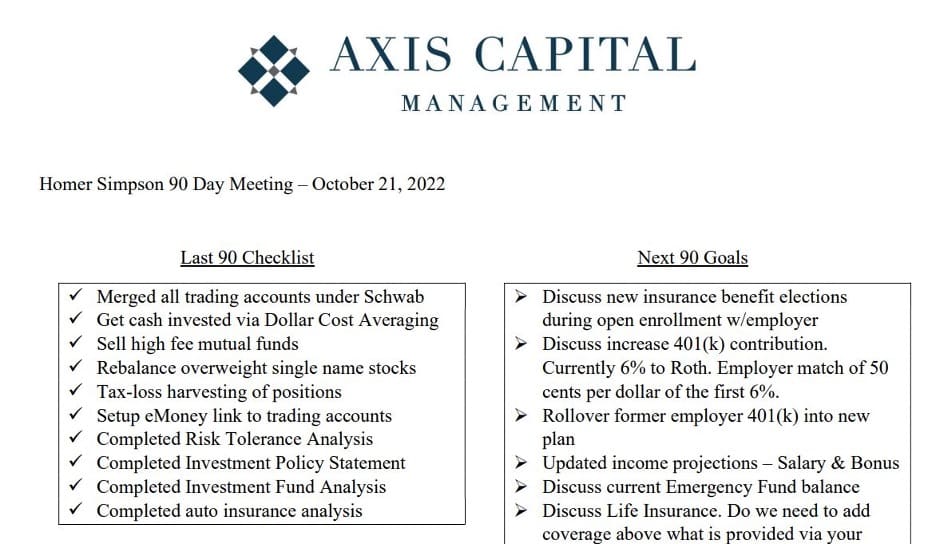

What is the nature of the reporting that would satisfy the regulator’s need to justify services rendered over a contract period.

Will advisors have to provide 200 page reports?

Or is it just a quarterly list of bulleted points, such as this example from Axis Capital Management?

What can advisors do?

- Be as transparent as you can be in how you present your financial planning offering. Here are tips.

- Get involved with your local regulators. Help educate and open their perspectives so they can create regulations that will allow them to serve their jurisdictions better. As a practitioner your experience is valid to this goal.

- Some states have Town Hall style meetings where you can voice your views. Attend and voice your views!

Opportunity to take a big step forward

Maybe these new financial planning regulations could lead us to a place, a more elevated level of service that will make planners more effective in aligning with the needs of their clients. There’s too much relying on the client to have to make sure there is value provided. If it were forced upon the planner to clearly detail exactly what it is and what it costs, that could be the biggest step forward the industry has ever taken, engendering more trust from the public and dispelling much of the negative reputations that the industry has.

What do you think?

Sara’s upshot on financial planning transparency

So there you have it – hope this podcast about changes in financial planning transparency was useful! Guess what – we’ve got a leeeetle bit of a movement going on!

Join our next Transparent Advisor virtual meetup.

These meetups are free and the goal is to learn from each other about how to grow and manage a transparent wealth management practice for the benefit of clients.

Even if you can not make the meetup, or even attend in its entirety, please register for the replay and to be notified of the next one. We meet on the second Wednesday of the month at 1 PM ET.

Disclosures

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use or mention in any of its content, or the success of any program it may mention in any of its content. Grillo Investment Management, LLC will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor. I want to be clear that nothing in this podcast or blog can be interpreted as an investment recommendation of any type. The opinions expressed herein do not necessarily represent the views of Sara Grillo or Grillo Investment Management, LLC. Also, nothing in this podcast or blog can be interpreted as legal or compliance advice. For advise on such matters, contact a legal or compliance advisor. Any similarities to persons deceased or alive are entirely coincidental.

Sources

Colorado Department of Regulatory Agencies. Division of Securities. March 2022. Ongoing Financial Planning Guide. https://drive.google.com/file/d/1uoEh8yZUPr6LovQyMQhmeW1Ufp_lgUVW/view

Colorado Department of Regulatory Agencies. Division of Securities. November 2022. Ongoing Financial Planning Guide. https://drive.google.com/file/d/1uoEh8yZUPr6LovQyMQhmeW1Ufp_lgUVW/view