Podcast: Play in new window | Download

This is a very serious and important message. Please talk to your clients about Robinhood ASAP and teach them how to protect their kids. Young adults are getting access to reckless financial advice from social media at a younger and younger age, with unlimited potential for damage. It’s serious and financial advisors need to take action to protect these vulnerable members of our society, and specifically their clients’ young adult children.

Please take the actions I describe in this article to protect your clients and their kids, and society at large. Financial advisors, you are the stewards of people’s hopes and dreams. You have the knowledge that is needed to protect vulnerable populations such as young adults who are getting frivolous advice from social media sites, and then trading on it commission-free and using margin. It’s dangerous and serious and you have a responsibility, financial advisors, to those you serve to protect them from this.

Online trading is a threat to young adult population

Online trading has become the new “gambling” and it’s having more and more of an impact on the families you are working with. According to an article from InvestmentNews, this trend is on the rise.

Robinhood users are 14 times more likely to default on their margin loans, according to a study by CBS news. I’m terrified to think what will happen if the market crashes. Suicides increase in tough economic times, and suicide is the second largest killer of people ages 10 to 34 in the US, according to the National Institute of Mental Health.

Sadly, a young man took his own life last year because he traded on margin and he believed he had a six figure loss which turned out to be displayed due to a computer glitch. I can not believe that somebody’s baby boy was lost over this.

Let me make it clear: more young people are going to die if the market crashes unless we stand up right and take action right now.

The hope here is that reform takes place before the next recession. But we can’t sit and wait; we have to take action now to stop this before it’s too late. There are many actions we need to take and we can’t assume we have much time. Our quickest action step is for financial advisors to get out their and talk to your clients about Robinhood and the dangers it presents.

Frivolous trading advice abounding as the crypto bubble grows

Influencers like Elon Musk are admired and people will often trust what they say. Lindsay Lohan last week tweeted “Bitcoin to the moon” and other celebrities have made similar statements. They do have a great power over what people think, and yet they have zero responsibility under the law, and do not have the face consequences for the financial advice that they give.

Celebrities are admired, especially by younger populations. Many want to be like them and will take action on what they say without too much thought as to if it is right or not. Young people admire the influencers they see on social media and the numbers are growing explosively.

Failing to talk to your clients about Robinhood, Reddit, and other “pop finance” threats could impact financial advisors’ businesses

This may potentially have an impact potentially for your business. This could potentially become a serious problem for your clients and their families if their kids get on Robinhood and squander away $200k and your clients are going to be the ones holding the bag. This can ruin families and ruin people’s lives.

Regulators allowing loophole to exist

You can not wait for regulators to take action; you have to take action now to protect your clients. There is a regulatory loophole. There is no oversight right now from the SEC and FINRA when it comes to unregistered, unregulated people. I’m somewhat of a social media influencer and I know that I can’t go on YouTube or LinkedIn and tell everybody to go take Vitamin D because that’s giving medical advice and I don’t want to get in trouble for it with the FDA. But there is no such regulation when it comes to stock advice for these unregistered people, and I do see unregulated people with no licenses getting away with murder, making recommendations without having to qualify the risks, back it up with research, or use adequate disclosures.

I’ve reached out to the regulators to request conversations. I will continue to do so.

It is time for advocacy

Make blogs, make podcasts, make newsletters, webinars, videos, teach your clients to talk to their kids. Teach your clients and their kids about setting limits on trading. Talk to them about teaching their kids about margin, about shorting, about short squeezes. The regulators are not going to do this anytime soon. You are the stewards, the protectors, the leaders, the ones with the information and knowledge that is needed here to protect society’s vulnerable populations.

Talk to your clients about Robinhood, Reddit, TikTok, Instagram, and the dangers of taking advice from these platforms. Discuss topics such as the following -how do you teach your kids about what is responsible day trading, and what is not? Should you let your kids trade on advice you get from TikTok? What is margin? How do you calculate it? All of these questions you should be discussing when you talk to your clients about Robinhood.

Financial advisors, you are the advocates that our society needs to protect its most vulnerable members from this threat. You have the information and knowledge that they need to hear.

Please hear what I have said and take action today to protect your clients, their children, the people following you on social media, and encourage any influencer in your network to do the same. If you have questions about how to use your marketing to this end, please send me a message. I may require some time, but I will answer as I can.

You may use this Responsible Trading article if you wish

I also have composed the article below that you may use as a model to communicate these ideas to your clients. Please feel free to use the article called “How to protect your kids from Reddit, Robinhood, and other social media sites encouraging reckless trading” below to communicate with your clients. This is only a template or rough sketch; you may wish to alter it to meet your style. If you do utilize this article, please remember you must have it reviewed and approved by your compliance team before sending to clients – this is not already compliance approved.

<Beginning of article>

How to protect your kids from Reddit, Robinhood, and other social media sites encouraging reckless trading

Online trading has become more risky

Online trading has become society’s newest form of gambling for young adults in our society. This is in part due to the rise of commission free trading by brokerages, as well as the high levels of margin available through certain platforms. All of this has elevated the role of trading from a hobby or pastime to an activity with the potential to ruin a person’s financial future – and in some cases, it unfortunately has.

The growth of social media, and the higher potential for influencers to make money from their followings has also played a role in encouraging risky, reckless investing behavior. There are many instances of this causing considerable damage to the investing public, including a young man who apparently killed himself after seeing a six-figure loss in his Robinhood account.

For these reasons, I encourage you to pass the following information on to your children, any young adult you know, or any individual that you know who may be participating in online trading. You may also refer them to the sources listed at the bottom of this article for further explanation of the concepts discussed.

How online influencers make money and the potential bias that goes along with it

Social media influencers are not always objective in their views. For all of the following reasons, recommendations made on the internet may be highly biased to benefit the person making the call, and should not be assumed to be objective, independent, or made 100% in your favor.

- Often social media influencers are motivated to talk about controversial topics or make exaggerated statements to attract attention and grow their followings. This is because many of them get paid higher advertising revenue for higher views on their posts.

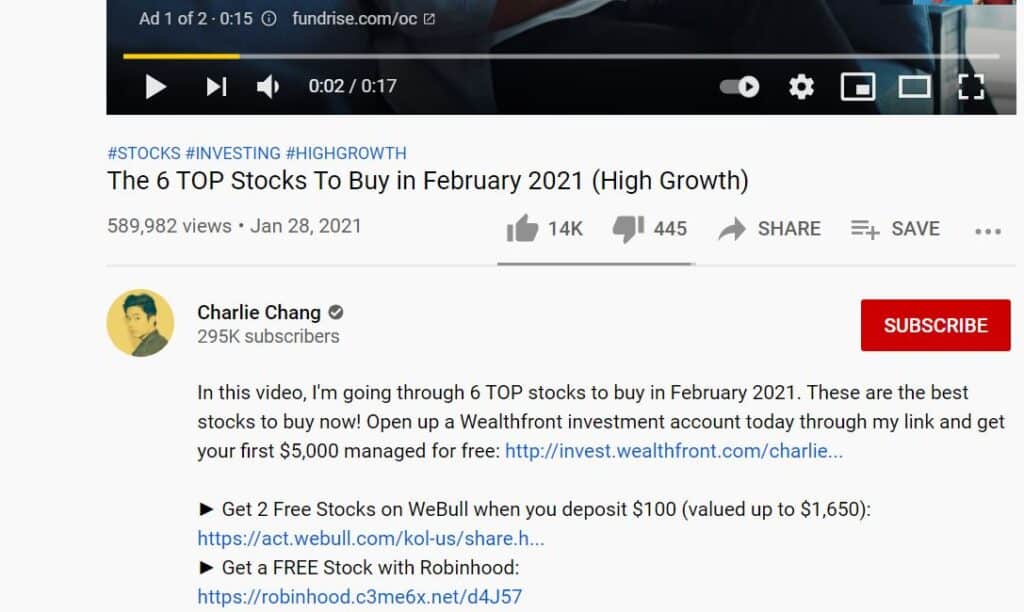

- Influencers may also earn money by encouraging their followers to by products that they receive an affiliate payment, or kickback, on through use of affiliate links. Someone may say, for example, to click a link below their video to open an account at a certain brokerage firm for a discount so that they can make the trades mentioned in the person’s video. The following video shows an example of affiliate marketing.

- Influencers may also benefit from you taking action on certain positions that they hold or intend to get involved with. If they hold a certain stock, they stand to benefit from massive buying action taken by others on the same position. If they intend to buy a certain position, they will benefit from massive selling action on that security prior to purchase.

- Influencers may neglect to fully disclose all of the risks involved with making the investment in an effort to prompt followers to take action.

- They also may cite impressive historical track records without providing legitimite verification of these performance results, again to encourage followers to take any action that will benefit them.

Many online influencers make their recommendations merely on the news and do not conduct proper research as to the fundamentals behind the position. Often these influencers are not licensed, regulated, or registered representatives of any securities firm. As a result, they are given significantly more freedom to discuss high risk recommendations without having to fully disclose the potential downside of any investments they are recommending.

Margin, shorting and unlimited potential for loss

Certain brokerage positions may offer you margin as a way to potentially magnify the gains made from trading. Trading on margin is a high-risk activity and you have the potential to lose substantial amounts of money if the market moves against you. Margin is defined as money borrowed from the brokerage firm you are trading with. In essence, you are getting a loan from the broker, one that is not forgivable under any circumstances and that you must pay interest on. Please refer to this description of how margin works from Charles Schwab.

Short selling is a high-risk form of trading. You borrow a stock on margin and then sell it, with the understanding that you will buy it back. Your hope is that the stock drops in price so that you can profit from the difference between what you sold it for and what you bought it for. Because stocks have the potential to rise indefinitely in price, the potential for loss on a short position is unlimited. Please take precautions and understand the risks of short selling before doing so.

Responsible trading tips

- Before you take advice from someone on the internet making an investment recommendation, ask yourself what they stand to gain by you taking the action they recommend.

- Conduct your own research, and consult numerous information sources with varying and opposing opinions on any particular position, including those by licensed, regulated professionals who are obligated to discuss in full each and every risk inherent in the investment.

- Take the highest of precautions when investing in speculative stocks, engaging in short selling, or trading on margin, as the potential for loss is high and in some cases may be unlimited.

- If you have any questions about what you are trading, stop and consult a qualified, licensed, and regulated financial professional before going through with the trade.

- Always consider the maximum potential for loss and thoroughly research all of the risks involved before initiating any trade.

- Calculate your own margin and map out loss scenarios before trading. Always do your own margin calculations as you trade because the brokerage firm could make a mistake.

Sources

Chang, Charlie. (2021, Jan 28th). The 6 TOP Stocks To Buy in February 2021 (High Growth). Retrieved from https://www.youtube.com/watch?v=Hz6EU_e34iI&t=10s

Egan, Matt. (2020, June 20th). CNN Business. Apparent suicide by 20-year-old Robinhood trader who saw a negative $730,000 balance prompts app to make changes. Retrieved from https://www.cnn.com/2020/06/19/business/robinhood-suicide-alex-kearns/index.html

Frederick, Randy. (2021, February 12). Margin: How does it work? Charles Schwab. Retrieved from https://www.schwab.com/resource-center/insights/content/margin-how-does-it-work.

Little, Ken. (2020, January 19th). Short selling stocks – not for the faint-hearted. Retrieved from https://www.thebalance.com/short-selling-stocks-not-for-the-faint-hearted-3140549

Singh, Manoj. (2021, Jan 9). Investopedia. How to become your own stock analyst. Retrieved from https://www.investopedia.com/articles/basics/09/become-your-own-stock-analyst.asp

<End of article>

(please don’t copy this part below)

Talk to your clients about Robinhood and help them protect their kids TODAY

I am only one person, and there are 13 million people trading on Robinhood. I may be the first one to stand in between the vulnerable and the darkness, and I may be the only one. But I’m standing here, and I’m not gonna back down. I am prepared to have to get alot stronger, alot louder, alot bigger if that is what it takes.

What steps will you take? Do a little or do alot, but please – do something.

-Sara

Disclosures

Grillo Investment Management, LLC does not guarantee any specific level of performance, the success of any strategy that Grillo Investment Management, LLC may use, or the success of any program.

Grillo Investment Management, LLC will strive to maintain current information however it may become out of date. Grillo Investment Management, LLC is under no obligation to advise users of subsequent changes to statements or information contained herein. This information is general in nature; for specific advice applicable to your current situation please contact a consultant or advisor.

Sources

InvestmentNews. (15 Feb 2021). Viral or Vicious? Financial advice explodes on TikTok. Retrieved from https://www.investmentnews.com/financial-advice-blows-up-on-tiktok-but-at-what-cost-202260

Redman, Jamie. (10 February 2021). Bitcoin.com. Lindsay Lohan Tweets ‘Bitcoin to the Moon’- Celebrities Are Flocking to Crypto in Great Number. Retrieved from https://news.bitcoin.com/lindsay-lohan-tweets-bitcoin-to-the-moon-celebrities-are-flocking-to-crypto-in-great-number/

Gandel, Stephen. (2021, February 5). CBS News. Robinhood offers loans to buy stock — they were 14 times more likely to default. Retrieved from https://www.cbsnews.com/news/robinhood-stock-loans-were-14-times-more-likely-to-default-than-rivals/

Curry, Robin. (10 February, 2021). Robinhood Revenue and Usage Statistics (2020). Retrieved from https://www.businessofapps.com/data/robinhood-statistics/

National Institute of Mental Health. Suicide. Suicide is a Leading Cause of Death in the United States. Leading Cause of Death in the United States (2018). Retrieved from https://www.nimh.nih.gov/health/statistics/suicide.shtml. Via the CDC ’s National Center for Health Statistics